00015672642023FYfalse0.5Subsequent EventsThe Company evaluated subsequent events from the balance sheet date through March 14, 2024, the date which the financial statements were issued.

00015672642023-01-012023-12-3100015672642023-06-30iso4217:USD00015672642024-03-01xbrli:shares0001567264intensity:StockIncentivePlan2021Member2023-12-3100015672642023-12-3100015672642022-12-31iso4217:USDxbrli:shares0001567264intensity:SeriesBConvertiblePreferredStockMember2022-12-310001567264intensity:SeriesBConvertiblePreferredStockMember2023-12-310001567264intensity:SeriesCConvertiblePreferredStockMember2022-12-310001567264intensity:SeriesCConvertiblePreferredStockMember2023-12-3100015672642022-01-012022-12-3100015672642021-12-310001567264us-gaap:PreferredStockMemberintensity:SeriesBConvertiblePreferredStockMember2021-12-310001567264us-gaap:PreferredStockMemberintensity:SeriesCConvertiblePreferredStockMember2021-12-310001567264us-gaap:CommonStockMember2021-12-310001567264us-gaap:AdditionalPaidInCapitalMember2021-12-310001567264us-gaap:RetainedEarningsMember2021-12-310001567264us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001567264us-gaap:RetainedEarningsMember2022-01-012022-12-310001567264us-gaap:PreferredStockMemberintensity:SeriesBConvertiblePreferredStockMember2022-12-310001567264us-gaap:PreferredStockMemberintensity:SeriesCConvertiblePreferredStockMember2022-12-310001567264us-gaap:CommonStockMember2022-12-310001567264us-gaap:AdditionalPaidInCapitalMember2022-12-310001567264us-gaap:RetainedEarningsMember2022-12-310001567264us-gaap:CommonStockMember2023-01-012023-12-310001567264us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001567264us-gaap:AdditionalPaidInCapitalMemberus-gaap:WarrantMember2023-01-012023-12-310001567264us-gaap:WarrantMemberintensity:ConversionOfPreferredStockIntoCommonStockMember2023-01-012023-12-310001567264us-gaap:PreferredStockMemberintensity:SeriesBConvertiblePreferredStockMember2023-01-012023-12-310001567264us-gaap:PreferredStockMemberintensity:SeriesCConvertiblePreferredStockMember2023-01-012023-12-310001567264us-gaap:CommonStockMemberintensity:ConversionOfPreferredStockIntoCommonStockMember2023-01-012023-12-310001567264us-gaap:AdditionalPaidInCapitalMemberintensity:ConversionOfPreferredStockIntoCommonStockMember2023-01-012023-12-310001567264intensity:ConversionOfPreferredStockIntoCommonStockMember2023-01-012023-12-310001567264us-gaap:CommonStockMemberintensity:ConversionOfConvertibleNotesToCommonStockMember2023-01-012023-12-310001567264us-gaap:AdditionalPaidInCapitalMemberintensity:ConversionOfConvertibleNotesToCommonStockMember2023-01-012023-12-310001567264intensity:ConversionOfConvertibleNotesToCommonStockMember2023-01-012023-12-310001567264us-gaap:RetainedEarningsMember2023-01-012023-12-310001567264us-gaap:PreferredStockMemberintensity:SeriesBConvertiblePreferredStockMember2023-12-310001567264us-gaap:PreferredStockMemberintensity:SeriesCConvertiblePreferredStockMember2023-12-310001567264us-gaap:CommonStockMember2023-12-310001567264us-gaap:AdditionalPaidInCapitalMember2023-12-310001567264us-gaap:RetainedEarningsMember2023-12-310001567264us-gaap:IPOMember2023-07-050001567264us-gaap:IPOMember2023-07-052023-07-050001567264us-gaap:OverAllotmentOptionMember2023-07-070001567264us-gaap:OverAllotmentOptionMember2023-07-072023-07-070001567264intensity:SeriesBConvertiblePreferredStockMember2023-04-300001567264intensity:SeriesARedeemablePreferredStockMember2023-04-3000015672642023-04-300001567264intensity:SeriesCConvertiblePreferredStockMember2023-04-3000015672642023-04-012023-04-30xbrli:pure0001567264intensity:SeriesARedeemablePreferredStockMember2023-01-012023-12-310001567264intensity:SeriesARedeemablePreferredStockMember2022-01-012022-12-310001567264intensity:SeriesBConvertiblePreferredStockMember2023-01-012023-12-310001567264intensity:SeriesBConvertiblePreferredStockMember2022-01-012022-12-310001567264intensity:SeriesCConvertiblePreferredStockMember2023-01-012023-12-310001567264intensity:SeriesCConvertiblePreferredStockMember2022-01-012022-12-310001567264us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001567264us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001567264us-gaap:WarrantMember2023-01-012023-12-310001567264us-gaap:WarrantMember2022-01-012022-12-310001567264us-gaap:ConvertibleDebtMemberintensity:A2021ConvertibleNoteMember2021-09-300001567264us-gaap:ConvertibleDebtMemberintensity:A2022ConvertibleNoteMember2022-11-300001567264us-gaap:ConvertibleDebtMemberintensity:A2023ConvertibleNoteMember2023-05-310001567264us-gaap:ConvertibleDebtMember2021-12-310001567264us-gaap:ConvertibleDebtMemberintensity:A2022ConvertibleNoteMember2022-01-012022-12-310001567264us-gaap:ConvertibleDebtMember2022-12-310001567264us-gaap:ConvertibleDebtMemberintensity:A2023ConvertibleNoteMember2023-01-012023-12-310001567264us-gaap:ConvertibleDebtMember2023-01-012023-12-310001567264us-gaap:ConvertibleDebtMember2023-12-310001567264us-gaap:ConvertibleDebtMember2023-07-052023-07-050001567264us-gaap:IPOMember2023-06-292023-06-290001567264us-gaap:IPOMember2023-06-290001567264us-gaap:IPOMember2023-07-070001567264us-gaap:CommonStockMember2023-06-292023-06-290001567264intensity:SeriesARedeemablePreferredStockMember2023-06-290001567264intensity:SeriesBConvertiblePreferredStockMember2023-06-290001567264intensity:SeriesCConvertiblePreferredStockMember2023-06-290001567264intensity:SecurityAgreementAdditionalStockMemberintensity:SeriesBConvertiblePreferredStockMember2023-06-292023-06-290001567264intensity:SecurityAgreementAdditionalStockMemberintensity:SeriesCConvertiblePreferredStockMember2023-06-292023-06-290001567264us-gaap:ConvertibleDebtMember2023-06-292023-06-290001567264intensity:StockIncentivePlan2021Member2021-12-310001567264intensity:StockOptionPlan2013Member2021-12-310001567264intensity:StockIncentivePlan2021Member2022-01-010001567264intensity:StockIncentivePlan2021Member2021-01-012021-12-310001567264us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310001567264us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310001567264us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310001567264us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001567264us-gaap:EmployeeStockOptionMembersrt:MinimumMember2023-12-310001567264srt:MaximumMemberus-gaap:EmployeeStockOptionMember2023-12-310001567264us-gaap:EmployeeStockOptionMember2022-12-310001567264us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001567264us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001567264us-gaap:EmployeeStockOptionMembersrt:MinimumMember2023-01-012023-12-310001567264srt:MaximumMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001567264us-gaap:EmployeeStockOptionMembersrt:MinimumMember2022-01-012022-12-310001567264srt:MaximumMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001567264us-gaap:WarrantMembersrt:MinimumMember2023-12-310001567264srt:MaximumMemberus-gaap:WarrantMember2023-12-310001567264us-gaap:WarrantMember2022-12-310001567264us-gaap:WarrantMember2023-01-012023-12-310001567264us-gaap:WarrantMember2022-01-012022-12-310001567264us-gaap:WarrantMembersrt:MinimumMember2023-01-012023-12-310001567264srt:MaximumMemberus-gaap:WarrantMember2023-01-012023-12-310001567264us-gaap:WarrantMember2023-12-310001567264us-gaap:WarrantMemberintensity:UnderwriterMember2023-01-012023-12-3100015672642017-01-31utr:sqft00015672642017-02-2800015672642023-07-310001567264us-gaap:RelatedPartyMember2023-01-012023-12-310001567264us-gaap:RelatedPartyMember2022-01-012022-12-310001567264us-gaap:RelatedPartyMember2023-10-310001567264us-gaap:DomesticCountryMember2023-12-310001567264us-gaap:StateAndLocalJurisdictionMember2023-12-310001567264us-gaap:DomesticCountryMember2022-12-310001567264us-gaap:StateAndLocalJurisdictionMember2022-12-31 UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark one)

x ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

or

o TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to ______________

Commission File Number 001-41109

INTENSITY THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 46-1488089 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

| | | |

1 Enterprise Drive, Suite 430 | | |

Shelton, CT | | 06484-4779 |

| (Address of principal executive offices) | | (Zip Code) |

(203) 221-7381

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, $0.0001 par value | | INTS | | The Nasdaq Stock Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

Large accelerated filer o | Accelerated filer o | Non-accelerated filer x | Smaller reporting company x | Emerging growth company x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. o

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act of 1934). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on The Nasdaq Stock Market on June 30, 2023, was $22.0 million.

As of March 1, 2024, the registrant had 13,709,377 shares of common stock, $0.0001 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, contained in this report, including statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans, objectives of management and expected market growth are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “will,” “project,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements include, among other things, statements about:

•the initiation, timing, progress and results of future preclinical studies and clinical trials, and our research and development programs;

•our need to raise additional funding before we can expect to generate any revenues from product sales;

•our plans to develop and commercialize our product candidates;

•the timing or likelihood of regulatory filings and approvals;

•the ability of our research to generate and advance additional product candidates;

•the implementation of our business model, strategic plans for our business, product candidates and technology;

•our commercialization, marketing and manufacturing capabilities and strategy;

•the rate and degree of market acceptance and clinical utility of our system;

•our competitive position;

•our intellectual property position;

•developments and projections relating to our competitors and our industry;

•our ability to maintain and establish collaborations or obtain additional funding;

•our expectations related to the use of our cash and cash equivalents and investments; and

•our estimates regarding expenses, future revenue, capital requirements and needs for additional financing.

These forward-looking statements reflect our management’s beliefs and views with respect to future events and are based on estimates and assumptions as of the date of this Annual Report on Form 10-K and are subject to risks and uncertainties. We discuss many of these risks in greater detail under “Risk Factors.” Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

You should read this Annual Report on Form 10-K and the documents that we have filed with the SEC as exhibits to this Annual Report on Form10-K and with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect. We qualify all forward-looking statements in this Annual Report on Form 10-K by these cautionary statements. Except as required by law, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise.

PART I

Item 1. Business

OVERVIEW

Intensity Therapeutics, Inc. is a late-stage clinical biotechnology company passionately committed to applying scientific leadership in the field of localized cancer reduction leading to anti-cancer immune activation. Our new approach involves the direct injection into tumors of a unique product created from our DfuseRxSM discovery platform.

Intratumoral (“IT”) treatment, or treatment designed to contain a drug inside a tumor without spreading to the rest of the body, has been an objective of clinicians since discovery of chemotherapeutic agents. The challenge with IT treatment approaches is that a tumor’s lipophilic, high fat, dense and pressurized microenvironment is incompatible with and does not absorb water-based products. We believe that this drug delivery challenge limits the effectiveness of prior and current IT treatments, which involve injecting aqueous drugs into a tumor without sufficient consideration of the tumor environment (regardless of the drug’s mechanism or approach, i.e. the stimulation of an inflammatory response or efforts to attract immune cells into a hostile live tumor). Accordingly, there remains a continued unmet need for the development of direct IT therapies for solid tumors that provide high local killing efficacy coupled with nontoxic systemic anti-cancer effects. We believe we have created a product candidate with the necessary chemistry to overcome this local delivery challenge. Evidence shows the mechanism of tumor killing achieved by our drug candidate also leads to systemic immune activation and T-cell repertoire expansion in certain cancers.

Our platform creates patented anti-cancer product candidates comprising active anti-cancer agents and amphiphilic molecules. Amphiphilic molecules have two distinct components: one part is soluble in water and the other is soluble in fat or oils. When an amphiphilic compound is mixed with therapeutic agents, such as chemotherapies, the agents also become soluble in both fat and water. Our product candidates include novel formulations consisting of potent anti-cancer drugs mixed together with these amphiphilic agents.

Our lead product candidate, INT230-6, is primarily comprised of three components: (i) cisplatin, a proven anti-cancer cytotoxic agent, (ii) vinblastine sulfate, also a proven anti-cancer cytotoxic agent, and (iii) an amphiphilic molecule (“SHAO”) which enables the two cytotoxic agents to disperse through a tumor and diffuse into cancer cells following a direct intratumoral injection. These three components are mixed and combined into one vial at a fixed ratio. Cisplatin and vinblastine sulfate are both generic and available to purchase in bulk supply commercially. The United States Food & Drug Administration (the “FDA”) has approved both drugs as intravenous agents for several types of cancers. Cisplatin was first approved in 1978 for testicular cancer, and is also approved in ovarian and bladder cancer. The drug is also used widely in several other cancers including pancreatic and bile duct cancer. Vinblastine sulfate was first approved in 1965, and is also approved in generalized Hodgkin’s disease, lymphocytic lymphoma, advanced carcinoma of the testis, and certain types of sarcoma. The drug is also used in breast and lung cancer.

In 2017, we initiated a Phase 1/2 dose escalation study (“IT-01”) using INT230-6 in the United States under an investigational new drug application (“IND”) authorized by the FDA and in Canada under a preclinical trial application (“CTA”) approved by Health Canada (“HC”). The study tested the safety and efficacy of INT230-6 in patients with refractory or metastatic cancers, and enrolled 110 patients in three arms: (i) INT230-6 used as a monotherapy, (ii) INT230-6 in combination with Merck’s Keytruda® (pembrolizumab), and (iii) INT230-6 in combination with Bristol Myers Squibb’s (“BMS”) Yervoy® (ipilimumab). We completed enrollment of IT-01 in June 2022, locked the IT-01 database in February 2023 and finalized the clinical study report in September 2023. We delivered the combination-specific reports and other information to our partners in the fourth quarter of 2023.

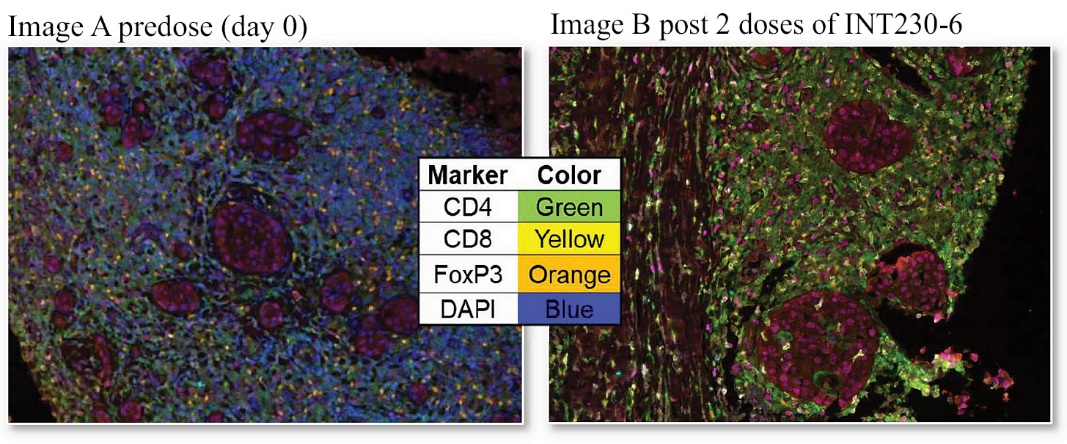

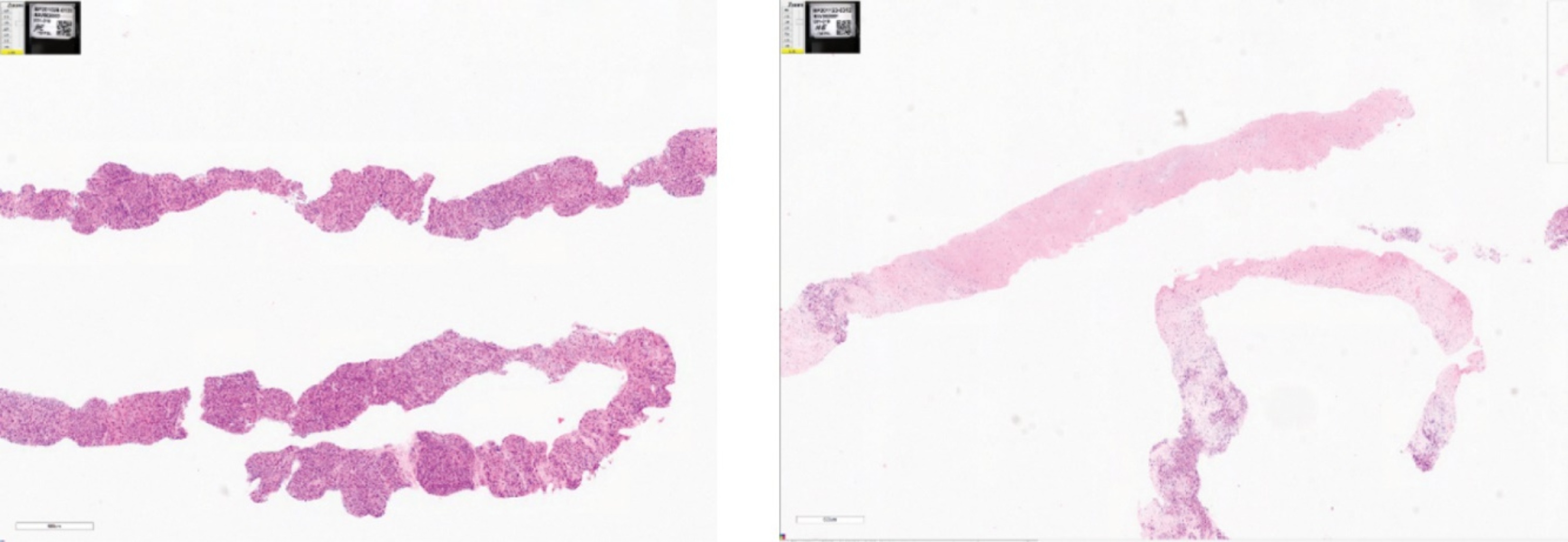

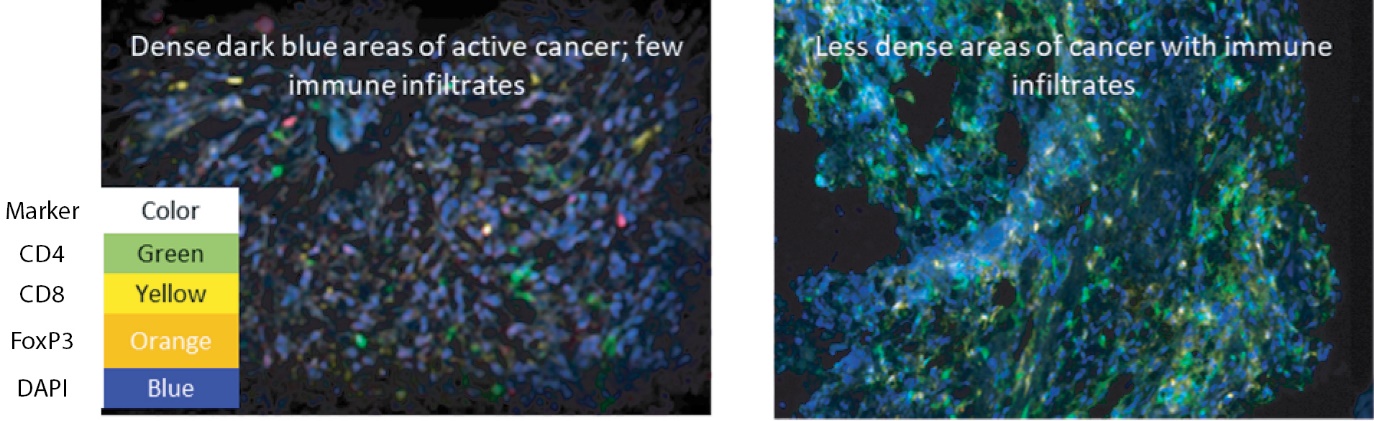

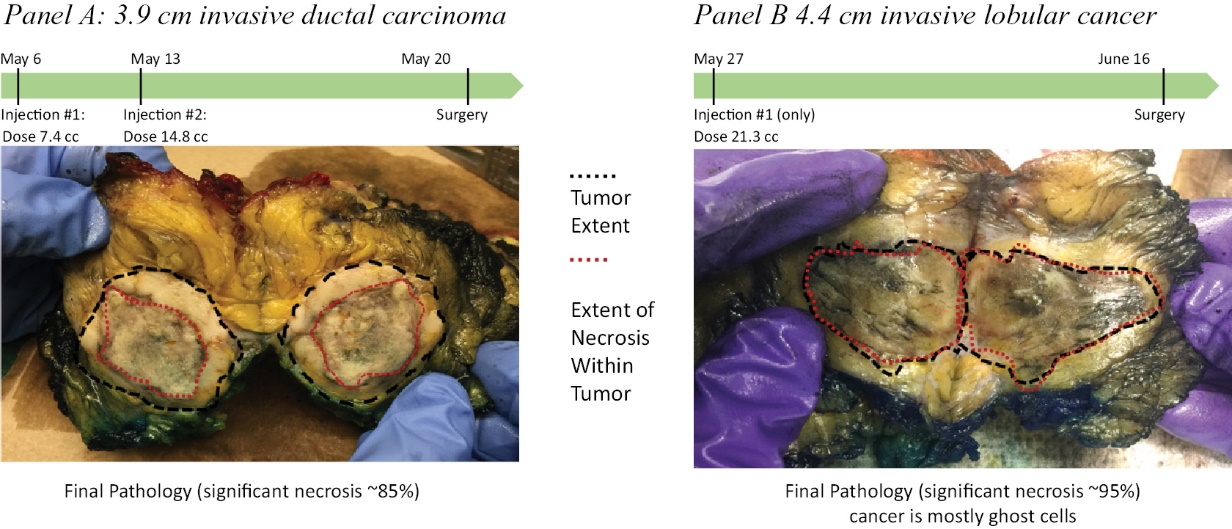

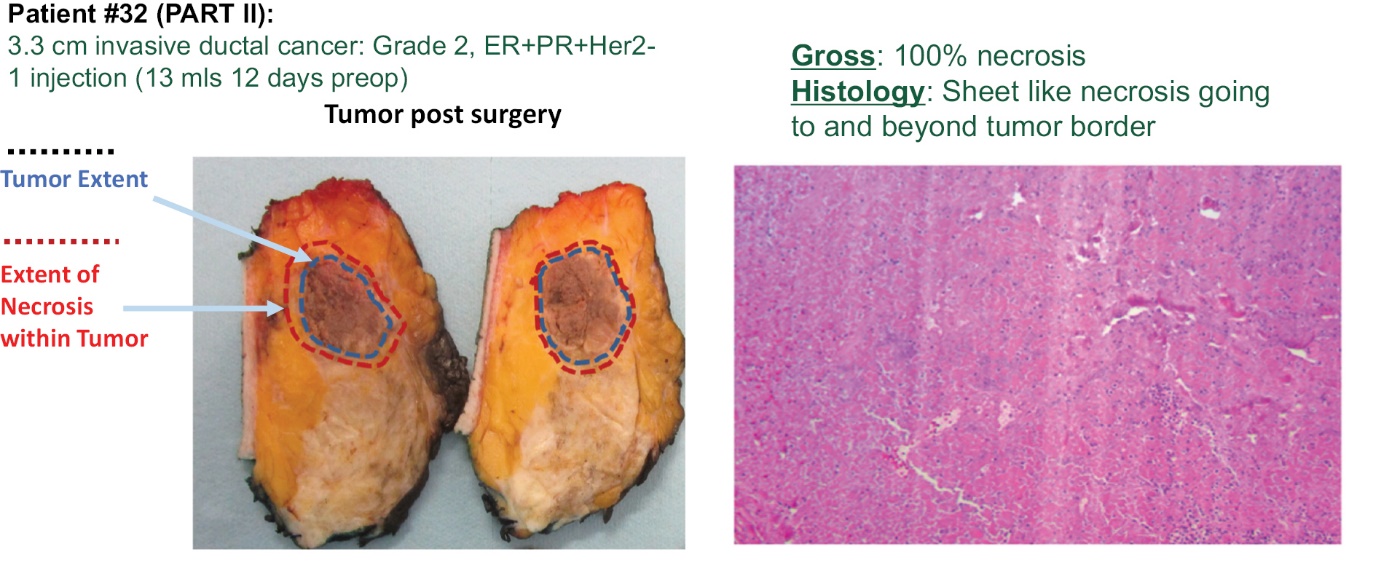

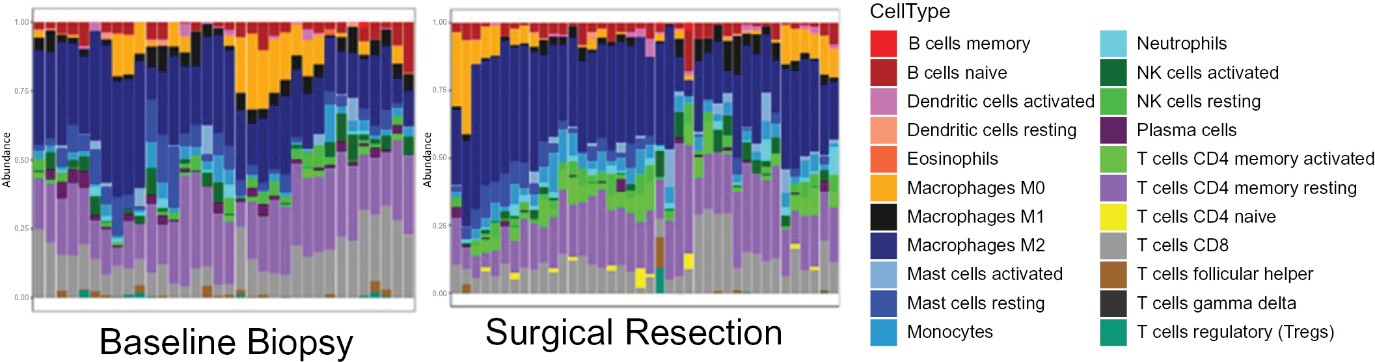

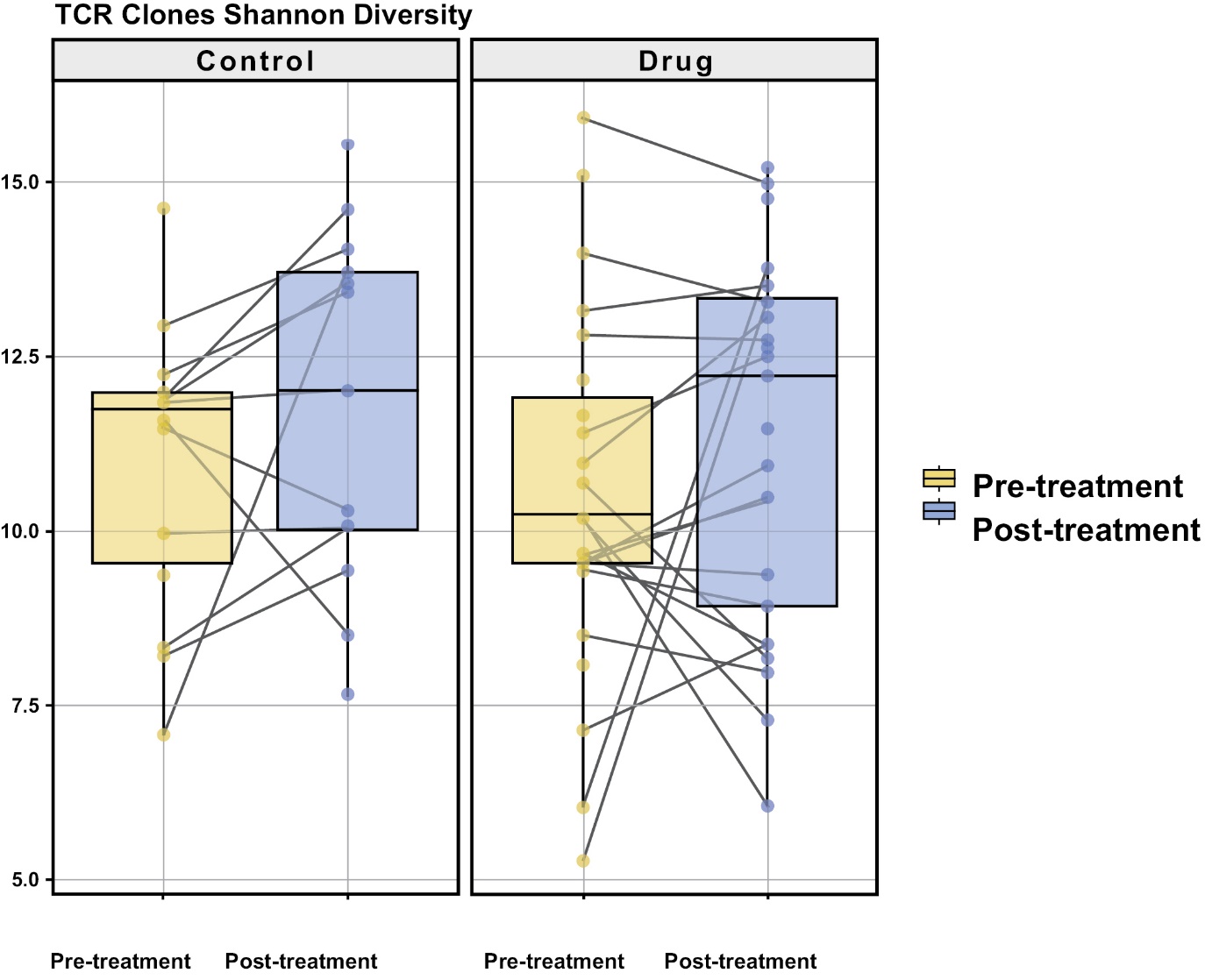

In 2021, we initiated a Phase 2 randomized study that tested INT230-6 as a monotherapy treatment in early-stage breast cancer for patients not suitable for presurgical chemotherapy (the “INVINCIBLE-2 Study” or “IT-02”). The study enrolled 91 subjects and the database was locked in November 2023. The key endpoint was whether INT230-6 could reduce a patient’s cancer compared to no treatment, which is the current standard of care (“SOC”), or a saline injection. Substantial reduction of cancer presurgically in aggressive forms of cancer has been shown to correlate with delaying disease recurrence. Other endpoints of the INVINCIBLE 2 Study were to understand the percentage of necrosis that can be achieved in tumors for a given dose, especially tumors larger than 2 centimeters in longest diameter, and whether either a local or whole-body anti-cancer immune response could be induced. The INVINCIBLE-2 Study demonstrated a high order of necrosis in presurgical breast cancer tumors in the period from diagnosis to surgery, with some patients experiencing greater than 95% necrosis of the tumor. Data from the INVINCIBLE-2 Study demonstrated that INT230-6 had a favorable safety profile. An increase of certain types of immune cells (CD4+ and NK T-cells) in the tumor and blood was also shown. Additionally, there was an increase in the T-cells repertoire relative to control.

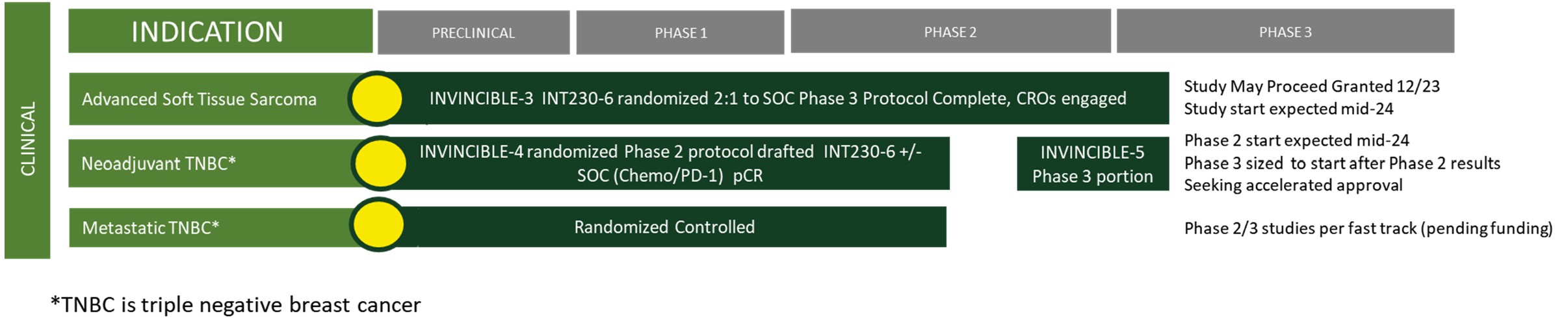

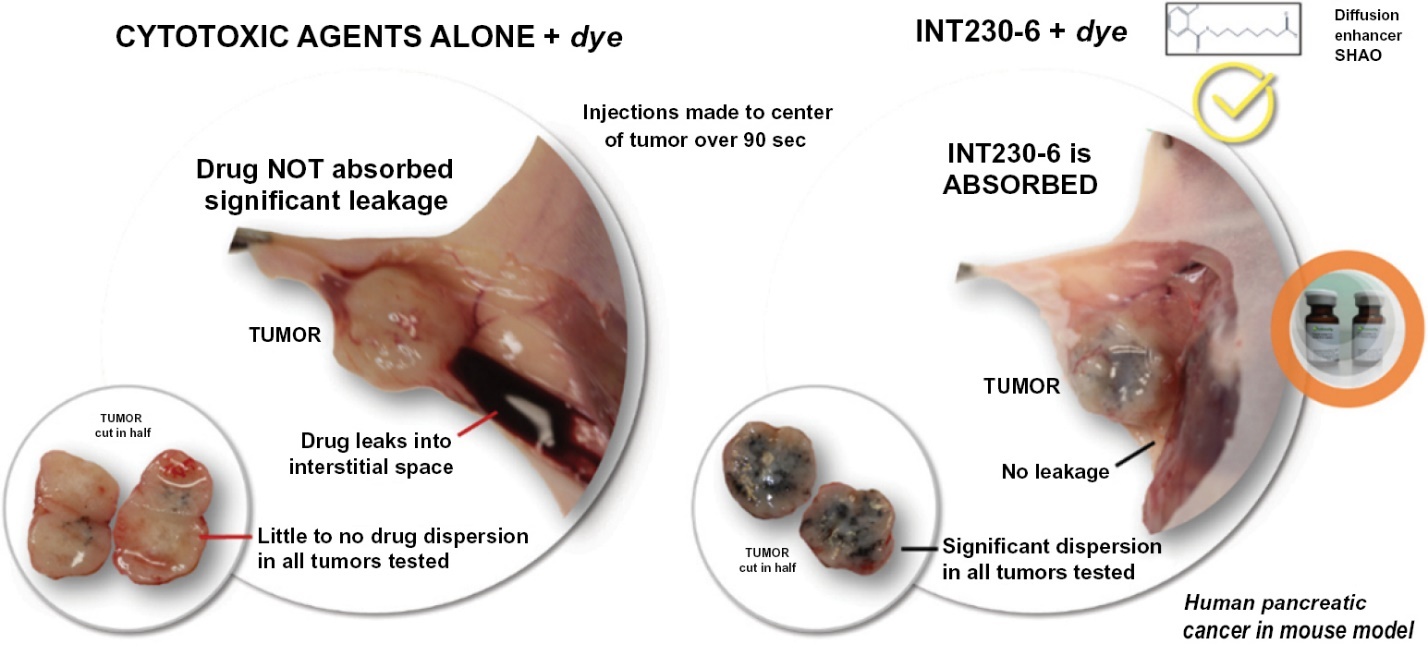

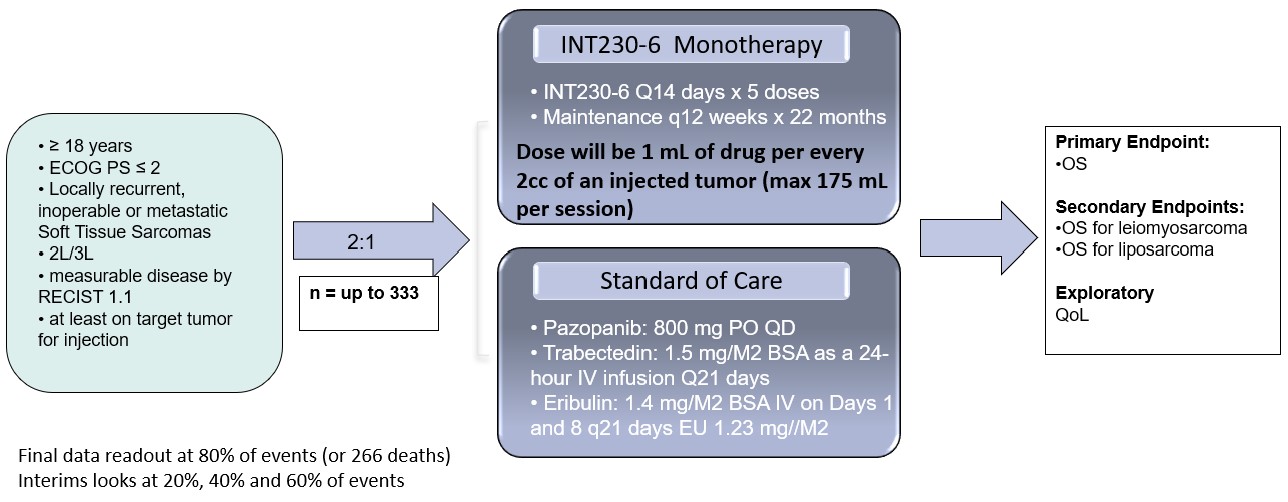

In mid-2024, we intend on initiating a Phase 3 open-label, randomized study testing the superiority INT230-6 used as monotherapy compared to the standard of care drugs in 2nd and 3rd line treatment for certain soft tissue sarcoma subtypes (the “INVINCIBLE-3 Study” or “IT-03”). We plan to enroll 333 patients with an endpoint of overall survival.

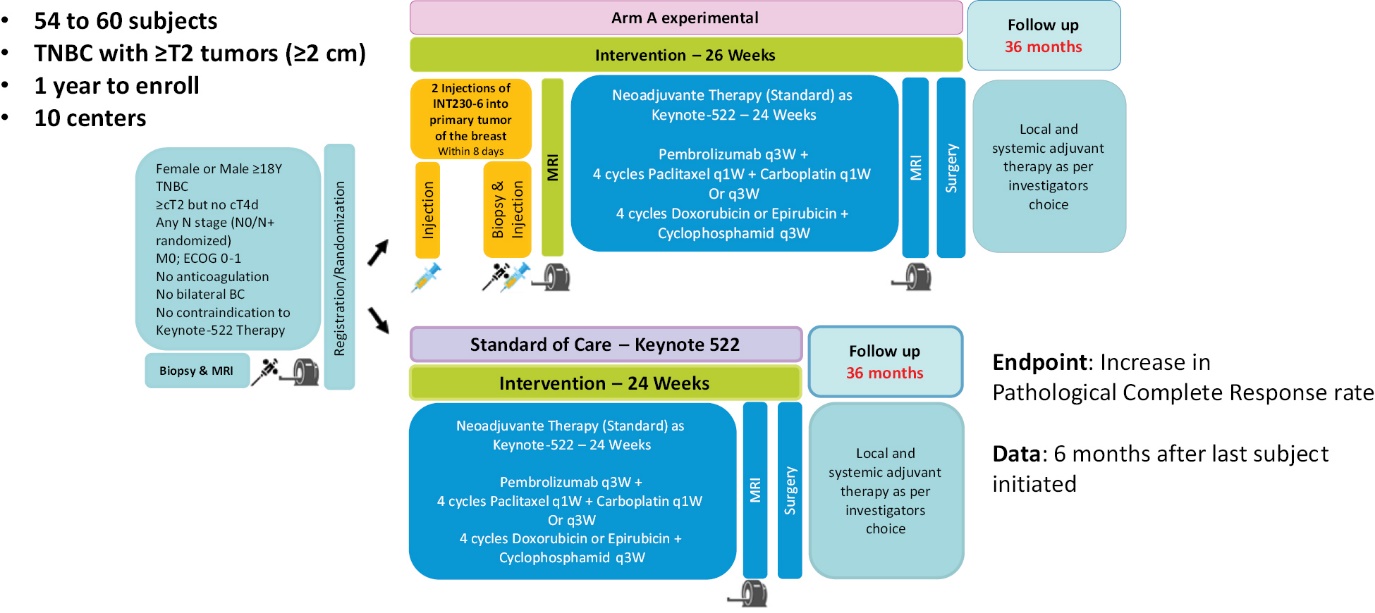

Also in mid-2024, we intend on initiating a Phase 2/3 program testing INT230-6 in combination with the SOC treatment (chemotherapy/immunotherapy) compared to SOC alone in women with triple negative breast cancer in presurgical (neoadjuvant) breast cancer (“IT-04”). The endpoint for the Phase 2 portion of the trial is the change in the pathological complete response rate for the combination compared to the SOC alone. We expect to begin the Phase 2 portion of the study in mid-2024, which will provide data to size the Phase 3 portion of the study.

We have also successfully developed Phase 3 quality analytical methods for the three INT230-6 components and successfully manufactured a large-scale batch of INT230-6. In a meeting with the FDA in the fourth quarter of 2023, we agreed on a chemical manufacture and control (“CMC”) plan for Phase 3 and product registration for our three key ingredients and INT230-6. If we successfully execute the agreed upon plan, the CMC portion of a New Drug Application (“NDA”) should be acceptable to the FDA for product approval and registration (subject to final NDA review).

Our Pipeline

Our pipeline is focused on realizing the full potential of INT230-6 in metastatic and local disease settings to help cancer patients with major unmet medical need. We are exploring the use of INT230-6 across multiple cancer types (including those types that do not normally respond to immunotherapy) and “hot” tumors (cancer types that are more likely to respond to immunotherapy).

Based on data generated in IT-01 and the INVINCIBLE-2 studies, our current forward pipeline consists of:

•A Phase 3 open-label, randomized study testing the superiority INT230-6 used as monotherapy compared to the standard of care drugs in 2nd and 3rd line treatment for certain soft tissue sarcoma subtypes. For every three patients enrolled, two will receive INT230-6 and one will receive SOC drug(s) chosen by the investigators depending on the type of sarcoma. The Company is working with several contracted vendors to initiate the Phase 3 trial. We plan to enroll 333 patients with an endpoint of overall survival. In September 2023, we announced that the FDA granted orphan drug designation for the treatment of soft tissue sarcoma to the three active moieties comprising INT230-6: cisplatin, vinblastine sulfate, and the diffusion enhancer SHAO.

•A Phase 2/3 study testing INT230-6 in combination with the SOC treatment (chemotherapy/immunotherapy) compared to the SOC alone in women with triple negative breast cancer in presurgical (neoadjuvant) breast cancer. The endpoint for the Phase 2 portion of the trial is the change in the pathological complete response rate for the combination compared to the SOC alone.

•A Phase 2/3 clinical study in metastatic triple negative breast cancer, contingent on raising additional capital to fund the study. In 2018, we received Fast Track Designation by the FDA to use INT230-6 in metastatic triple negative breast cancer for patients whose cancer has progressed following one or two prior drug treatments.

In addition, we plan to continue to research and test new product candidates with improved immune activating properties. Through research studies conducted in animals, we have identified a promising product candidate currently designated as INT33X. We believe that the INT33X product candidate development program will most likely lead to the creation of new patents and other intellectual property. As part of our development program for INT33X, we will first conclude our on-going research studies in mice, after which we will finalize the exact product candidate composition before proceeding with clinical development.

Our Partnerships

•The National Cancer Institute (NCI). In May 2014, we were awarded a Collaboration Research and Development Agreement (CRADA) by the National Institute of Health’s National Cancer Institute. The research sought to understand the mechanism of action of INT230-6 and test the drug in several models in the NCI’s laboratories. The program resulted in a peer-reviewed publication titled Intratumorally delivered formulation, INT230-6, containing potent anti-cancer agents induces protective T-cell immunity and memory, which appeared in the journal OncoImmunology 2019 Vol 8 No 10; 15 and that was jointly authored by us and the NCI. The data for the paper was generated entirely by the NCI in their laboratories and reported the critical role of T-cells in promoting complete tumor regression using our drug candidate and that INT230-6 was synergistic with anti-PD-1 (programmed death receptor 1) and anti-Cytotoxic T Lymphocyte-Associated Antigen 4 (CTLA-4) antibodies.

•Merck. In June 2019, we entered into an agreement with Merck to evaluate the combination of INT230-6 with Keytruda® (pembrolizumab), Merck’s anti-PD-1 therapy, in patients with advanced solid malignancies, including pancreatic, bile duct, squamous cell and non-MSI high colon cancers. In our IT-01 study, we treated 30 patients with this combination arm. After nearly two years of dosing a combination of Keytruda and INT230-6, patients showed comparable safety to INT230-6 monotherapy. In addition, only three grade 3 immune-related adverse events reported in patients receiving the combination of INT230-6 with Keytruda. We completed study dosing in December 2022, finalized the clinical study report, tables, listings and figures for the Keytruda cohorts and provided the study information to Merck in December 2023.

•Bristol Myers Squibb. In April 2020, we entered into an agreement with BMS to evaluate the safety and efficacy of INT230-6 with Yervoy® (ipilimumab), BMS’s CTLA-4 immune checkpoint inhibitor, in patients with breast, liver, and advanced sarcoma cancer. In our IT-01 study, we treated 18 patients in this combination arm, and there was only one grade 3 immune-related adverse event (colitis) reported. We completed study dosing in December 2022, finalized the clinical study report, tables, listings and figures for the Yervoy cohorts and provided the study information to BMS in December 2023.

Our Clinical Data

INT230-6 has already generated anti-cancer evidence of activity as a single agent in clinical studies. Localized and abscopal effects have been observed in several patients. Tumor regressions with killing of the cancer cells is widely observed in injected lesions. Many patients who have exhausted all approved treatments for their types of cancer benefited from our product candidate. Our clinicians have reported tumor stabilization, tumor shrinkage, long periods without new tumors forming, size reductions of uninjected tumors and a reduction in disease symptoms. These results have been observed in combination with lower toxicities over a period of several months and post-treatment.

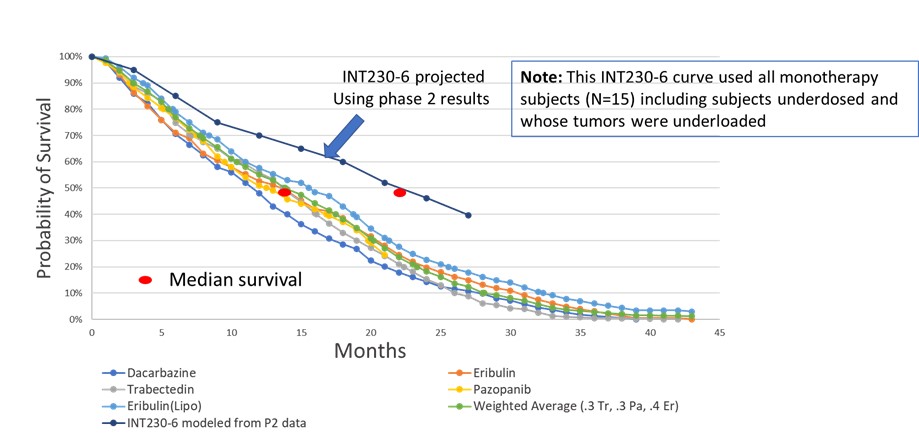

•Increased Survival Observed in Metastatic Disease. Preliminary data presented at the American Society of Clinical Oncology (ASCO) the Society for Immunotherapy of Cancer (SITC) and the Connective Tissue Oncology Society (“CTOS”) for sarcoma in 2022 and 2023 indicated that patients receiving INT230-6 appear to live longer compared to historical data for subjects in phase 1/2 sarcoma studies.

•Acceptable Safety Profile of the New Drug/Treatment Approach to Date. During the IT-01 study there were 820 injections of INT230-6 into 238 tumors, including 502 injections into visceral tumors deep in the body. Injection locations include the pancreas, liver, lung, and lymph nodes. No maximum tolerated dose had been reached. In our study IT-01 in metastatic patients, most adverse events were minor grade 1 or 2; a total of 15 patients out of 110 (13.6%) had a grade 3 even related to the drug regimen (INT230-6 alone or combined with the two immunotherapies). The primary grade 3 events were pain, anemia, rash, fatigue vomiting, dehydration and dizziness. There was 1 laboratory-based grade 4 adverse event that resolved quickly, a decrease in the number of neutrophils, the most common type of white blood cell that contributes toward the healing of damaged tissues and resolving infections. There were no grade 5 adverse events. Please see Table 1 and 2 in the “Results from IT-01 Phase 1/2 Clinical Trial” portion of our “Business” section on page 67 of this report for more information. We believe the safety profile consisted of mainly low grade related adverse events because the drug primarily stays in the tumor and the potent agents did not travel throughout the body. Measurement of the

amount of the drugs seen in the blood (pharmacokinetics or PK) indicated that more than 95% of the drug that was dosed remained in the tumor.

Our Manufacturing Capabilities

We work with clinical manufacturing organizations. In the fourth quarter of 2023, we successfully developed the Phase 3 quality analytical methods for measurement of the key INT230-6 components, validated those methods and manufactured our fourth current Good Manufacturing Practice (“cGMP”) clinical batch of the drug product that met specifications. During the fourth quarter, the Company requested and was granted a meeting that was held with the FDA to review the INT230-6 CMC for INT230-6. The CMC discussion focused on the tasks necessary to initiate the Phase 3 study and future product registration as part of a potential New Drug Application (NDA). During the meeting, the Company and the FDA agreed upon a plan for the CMC set of activities for the active pharmaceutical ingredients and the drug product (INT230-6) necessary for the NDA.

To commence the Phase 3 sarcoma program, we engaged contract research organizations to help manage the Phase 3 sarcoma study. We believe that INVINCIBLE-3 will be the first local therapy (though with systemic immune activating properties) to be tested as a single agent in metastatic disease compared to active SOC IV or oral agents.

Our Proprietary Drug Discovery platform, DfuseRxSM

Since our inception, we have conducted research using our discovery platform. Our technology platform allows us to identify novel product formulations and test the products’ activity in animal or test tube models of cancer. Using our platform technology, we evaluated several potential formulations comprising various amphiphilic molecules that act as cancer cell penetration enhancers. We tested formulations using our technology with many potent, anti-cancer drugs (with different mechanisms of action) in various combinations under several conditions to discover our lead product candidate, INT230-6.

Our Strategy

We believe our treatment approach may overcome some of the inherent problems of treating cancer with less toxicity. We intend to apply our deep understanding of our novel drug delivery technology to create a range of new direct killing and immune-activating products candidates while focusing on our lead clinical programs. If successful, we hope to fundamentally change the way cancer is treated for multiple cancer types in both the metastatic and presurgical disease settings.

We seek to build a company that develops and commercializes a new medicine and treatment methodology. By applying a disciplined focus on product development, we seek to transform the lives of cancer patients and change the very essence of cancer treatment.

Our objective is for patients to overcome their cancer without harm, to live a long life with high quality and to eliminate the fear of disease recurrence. We maintain a culture of high integrity that embraces the patient and their caregivers. A simple strategy: taking care of the patient will benefit all stakeholders.

Key elements of our strategy include:

•To focus our resources to aggressively pursue the research and development of our novel medicine to transform patient lives.

•To always remember that taking care of and benefiting the patient is the most important element to being successful.

•To effectively manage costs by outsourcing research and development to qualified, academic, private or government laboratories to leverage third-party expertise, while maintaining internal know-how, expertise and intellectual property.

•To build an internal team of experienced industry veterans that can work independently and who know how to get the product development job done.

•To create a large body of rigorous data, publications, presentations, collaborations and training materials about the new product candidates.

•To continuously communicate to the medical community and patients of the power of our new approach.

•To continue our commitment to precision medicine and personalized care for each and every patient.

•To assure that our technology is fully understood, explored, and used as designed.

Market Opportunities for Our Product Candidates

The development of a tumor is a complex biological process involving uncontrolled cellular division and growth. Cancer arises from mutations in our own cells. When such cellular alterations happen the immune system often cannot distinguish between cancer and healthy cells. Cancer cells adapt to evade and thwart immune cells in several ways and can thus grow unchecked.

According to the American Cancer Society, in 2024 there will be an estimated 2 million new cancer cases diagnosed and over 611,000 cancer deaths in the United States. Cancer is the second most common cause of death in the U.S. after heart disease. According to the American Society of Clinical Oncology’s journal, the ASCO Post, the national cost of cancer care in the United States is expected to rise to $246 billion by 2030. As healthcare costs in general continue to escalate, expenses due to cancer are a major contributing factor.

Metastatic Disease

The overwhelming, unmet medical need is better treatment of solid tumors; 90% of cancer patient deaths are due to solid tumors. Unfortunately, even with the best new therapeutic agents, the long-term survival rates for inoperable or metastatic cancer are extremely low (often single digits) and toxicity (the collateral damage to the patient’s health) is debilitating.

Five-year Survival Percentage Rates for Metastatic, Late-Stage Cancers

| | | | | | | | | | | | | | | | | | | | |

Cancer type | | 5 Year

Survival

(%)* | | Cancer type | | 5 Year

Survival

(%)* |

Breast | | 29 | | Ovarian | | 30 |

Colon/rectal | | 15 | | Pancreas | | 3 |

Esophagus | | 5 | | Prostate | | 30 |

Kidney | | 14 | | Sarcoma | | 16 |

Larynx | | 34 | | Testis | | 95 |

Liver | | 3 | | Thyroid | | 53 |

Lung/Bronchus | | 6 | | Urinary bladder | | 6 |

Melanoma (skin) | | 30 | | Uterine cervix | | 18 |

Oral cavity | | 40 | | Uterine corpus | | 16 |

____________

*For cancers that have moved to distal sites

Data sources for the above table: Surveillance, Epidemiology, and End Results National Cancer Institute, SEER 5-Year Relative Survival Rates, 2011 – 2017

In late-stage, metastatic disease, tumors often become resistant to all therapies, even after the agents have provided some efficacy benefit. The reality today for many cancer types is that if the disease is detected late, most treatments are highly toxic and few of today’s approaches provide patients with much hope of long-term survival. Even with good outcomes, whether by surgical, chemical, radiative, immunological or ablative methods, cancer treatments are invasive, have severe side effects, damage the body and are mentally demanding on patients and their families.

Local Disease

Today, the annual number of interventional oncology procedures in the U.S. alone are estimated in the millions. For example, the majority of breast cancer tumors identified are local to the breast or are regional. As a result, there are 170,000 lumpectomies performed in the U.S. each year. Dr. Roshni Rao, Chief, Breast surgery program, at New York-Presbyterian/Columbia University Medical Center wrote in the Cancer Letter that “although lumpectomy is the best option for many breast cancer patients, with 170,000 procedures performed annually, it is not perfect. All too often, a post-operative pathology report shows that while the surgeon may have removed the entire tumor, a second surgical procedure is needed to clean up lingering cancer cells. Known as re-excision, it occurs in roughly 20% to 25% of cases, on average. It is

critical for surgeons and their patients to have access to the latest innovations, once demonstrated effective by clinical research, be used wherever and whenever possible.” Our drug candidate’s potential to kill cancer quickly prior to surgery and engage an anti-cancer immune response may provide a higher percentage of patients a greater five-year event-free survival for a number of tumor types.

Breast Cancer

About 1 in 8 U.S. women (about 13%) will develop invasive breast cancer over the course of her lifetime. In 2024, there will be an estimated 313,510 new cases of invasive breast cancer diagnosed in women; 2790 new cases diagnosed in men, and an additional 56,500 new cases of ductal carcinoma in situ diagnoses in women. (Siegel et al., 2024). Breast cancer is the most commonly diagnosed cancer among American women. Breast cancer became the most common cancer globally as of 2021, accounting for 12% of all new annual cancer cases worldwide, according to the World Health Organization.

Approximately 11 – 17% of breast cancers test negative for estrogen receptors, progesterone receptors, and excess human epidermal growth factor receptor 2 (HER2) protein, qualifying them as triple negative (“TNBC”). TNBC is considered to be more aggressive and have a poorer prognosis than other types of breast cancer, mainly because there are fewer available targeted medicines especially for women have tumors above 2 cm in longest diameter. Patients typically receive chemotherapy. According to a study published in the Journal of Clinical Oncology, patients who fail two lines of therapy for TNBC typically progress within nine weeks. Those who have failed three lines progress within four weeks.

Sarcoma

Soft tissue sarcoma is a broad term for cancers that start in soft tissues (muscle, tendons, fat, lymph and blood vessels, and nerves). These cancers can develop anywhere in the body but are found mostly in the arms, legs, chest, and abdomen. There are many types of soft tissue tumors, and not all of them are cancerous.

There are many types of sarcoma; however, the three most common are bone sarcoma (referred to as osteosarcoma), leiomyosarcoma, undifferentiated pleomorphic sarcoma and liposarcoma. Leiomyosarcoma is a type of sarcoma that grows in the smooth muscles. The smooth muscles are also in the hollow organs of the body, including the intestines, stomach, bladder, and blood vessels. In females, there is also smooth muscle in the uterus. When sarcoma is metastatic prognosis is poor; even with chemotherapy, half of people diagnosed with metastatic disease die within 15 months. Each year, 12,000 people in the U.S. and 1,150 in Canada are newly diagnosed with soft tissue sarcomas. About 3,000 patients have bone sarcomas.

Chemotherapy Treatment

There is a high unmet medical need for improved cancer treatments. Currently, early detection coupled with surgery and systemic chemotherapy is the most effective treatment against most cancers. For metastatic disease, systemic chemotherapy represents the backbone of care for many cancers. However, chemotherapeutic resistance often results in therapeutic failure and eventually death. Not only is chemotherapy often ineffective for cancers that exhibit such resistance, but this approach is also highly toxic for many patients (Cancer Cell Int. 2015; 15:71). Almost all current anti-cancer drug therapies load drug throughout the entire body including classic chemotherapy before surgery (neoadjuvant), after surgery (adjuvant), targeted therapy, antibodies or antibody drug conjugates, liposomal or nanoparticle delivered drugs. Many cancer cells in tumors are located away from blood vessels (referred to have hypoxic regions) and systemic administration of chemotherapy is ineffective at delivering the needed amounts of the medicine to all parts of the tumor. A significant limitation of the current chemical-based anti-cancer treatments is proper drug delivery. Another challenge for systemic approaches is poor absorption or cellular mechanisms in the cancer cell to remove the drugs.

Immunotherapy

There has been much excitement over the past decade about the promise of immunotherapy in treating cancer. These novel product candidates are designed to mobilize an immune system to attack cancer. The field of cancer immunotherapy has become the primary focus of treatment for many tumor types. There is significant interest from pharmaceutical companies, physicians and patients in advancing new, immune-based treatment concepts. Today, some patients with formerly fatal cancers are experiencing long term survival benefits with immune-based treatments. Immunotherapy has shown promise against the most mutated cancers such as melanoma, renal cell carcinoma, squamous cell carcinomas and subsets of lung cancers. Often these new immune stimulating drugs work in patients having high levels of specific markers,

such as the percentage of a protein on the surface of the cancer cell known as PD-L1 or the number of genetic mutations that may have caused the cancer referred to as a tumor’s mutational burden.

Many cancers, however, are also unresponsive to immunotherapy. Even for those cancers that are considered “immunogenic”, many patients are unresponsive. As a result, immunotherapy has not worked well for the majority of solid tumor types, including sarcoma, pancreatic cancer, colon cancer, triple negative breast cancer and brain cancer. At times, when using immunotherapies, the immune system has trouble distinguishing cancer from normal tissue and attacks healthy cells. Thus, the immune therapies induce side effects. To enable more patients to benefit from immunotherapy, new technologies that are able to improve recognition of the cancer by the immune system, or disrupt the tumor’s ability to evade immune cells, are critical and strongly needed.

Challenges Facing Current Treatments

We believe that an effective cancer treatment must overcome three major problems.

1.The diverse nature of the disease: In most patients, there are two populations of the cancer with different physical properties. The local component is comprised of the well-defined, visual large tumors, seen in x-ray or imaging scans, that invade organs and tissue. The systemic aspect is comprised of cells circulating or implanted throughout the body. Essentially, cancer is often simultaneously both microscopic (unseen) and macroscopic (radiographically seen).

2.Unreachable parts of tumors: Current systemic methods of delivering cancer drugs either orally or intravenously (IV) do not reach many portions of tumors due to a lack of blood supply. These areas are referred to as hypoxic (low oxygen) regions. These areas of the tumor can also impede the influx of immune cells. Intravenous or system dosing of cytotoxic agents suppresses the systemic immune system (Mathios et al, STM 2016) and reduces the potential of immunotherapies.

3.Lack of immune cell recognition and activation by tumor processes to evade: Immune cells have difficulty recognizing/distinguishing cancer cells from normal cells. Cancer also can cloak itself from the immune cells and create barriers to reduce their influx into the tumor.

Our Treatment Approach

Our treatment concept pioneers a new approach to treating cancer — kill tumors in the body (in situ) to create from the patient’s own cancer a recognizable, high-quality material (referred to as antigen) for better immune cell engagement against the cancer (immunological cell kill).

Our new concept uses a delivery molecule to enable the dispersal of potent drugs throughout the tumor that can also diffuse into the cancer cells. This process effectively loads the tumor with strong killing agents, which are retained within the cells. The active agents themselves used in our product candidate also have properties that improve immune recognition of the cancer. At the right dose our product candidates can completely saturate an injected tumor delivering high concentrations of drug into the cancer cells and killing the entire tumor. This process removes the cancer’s cloaking system, decreases the barriers to immune influx and activates a body-wide anti-cancer immune response to attack the uninjected tumors and unseen metastases. Our clinical data suggests that not all tumors need be injected for long term disease control.

Through our novel, drug treatment technology, we hope to transform the lives of patients with cancer. Our objectives are to increase patient longevity, reduce side effects, remove the fear of treatment, empower the patient, and minimize the risk of disease recurrence.

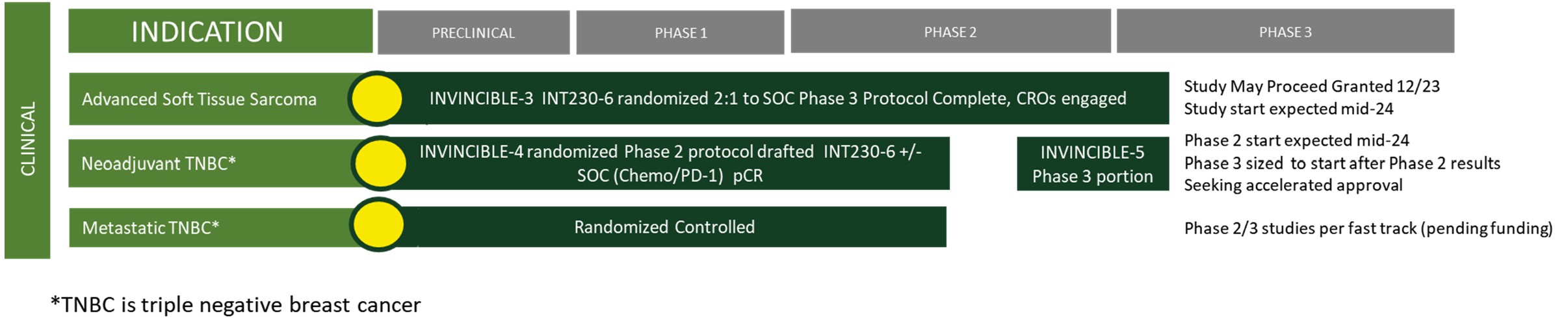

Our Lead Product Candidate: INT230-6

Our lead product candidate, INT230-6, is primarily comprised of three components: (i) cisplatin, a proven anti-cancer cytotoxic agent, (ii) vinblastine sulfate, also a proven anti-cancer cytotoxic agent, and (iii) SHAO, a penetration enhancing amphiphilic molecule. The SHAO chemical structure is shown in Figure 1 below. When injected into tumors, INT230-6 can kill the tumors. Our safety studies show that if the drug is (accidentally) injected into healthy tissue there is no observation of damage. The drug agents enter the blood stream at low doses. The unique amphiphilic SHAO compound formulated product candidate increases the dispersion of the drug throughout the tumor following intratumoral injection. Our technology is novel and unique. For those familiar with drug delivery technologies in cancer, it is important to understand that our product candidate is not a liposome, not a nanoparticle nor an emulsion. INT230-6 is a 100% water-

based formulation with tissue dispersion properties that do not destroy cancer cell membranes. We are unaware of any previous anti-cancer drug or prior intratumoral preparation with similar characteristics.

Figure 1 – Chemical Structure of SHAO

The SHAO molecule facilitates drug dispersion throughout the tumor. The molecule allows the tumor to absorb the killing agents and facilitates their diffusion into the cancer cells. Once in the cancer cell one drug cisplatin binds the DNA and causes the cell apoptosis (death) whereas the other agent, vinblastine sulfate, destroys the cell’s tubulin to shut down replication. Data in humans suggests that when administered at the proper drug dose to tumor volume ratio, a significant portion of the injected tumor can be killed on a single dose. In addition, there is evidence (in both animals and humans) that for certain cancers there is an activation of the immune system.

Our novel intratumoral (IT) technology is different than other IT approaches in four important ways:

1)We recognized that the composition of a tumor is highly unfavorable to direct injection of water-based products because the tumor has a high fat content and is under surrounding pressure. To be effective, an IT drug must disperse, be absorbed by the tumor and enter the cancer cell. Without our unique formulation chemistry water soluble drugs are not readily dispersed or absorbed by a tumor.

2)Our delivery technology is based on a proven science that uses amphiphilic molecules to transport drugs through tissue. The active drug agents in our lead product candidate (cisplatin and vinblastine sulfate) are established, commercial, potent killing agents with immune stimulating properties that as of now are only used as IV products. Both cisplatin and vinblastine sulfate have dual direct killing and immune activating mechanisms of action. Cisplatin binds to DNA to cause apoptotic cell death and also attracts and binds T-cells via TL9 receptors. Vinblastine sulfate destroys tubulin to stop replication and also induces dendritic cell maturation.

3)Unlike other IT products, our product candidates have multiple opportunities well beyond skin tumors, such as melanoma. Our lead product candidate, INT230-6, has shown the ability to kill tumors deep in the body such as in the liver, lung, and peritoneum. The product candidate has also demonstrated ability to kill tumors from several cancer types with abscopal effects and increased overall survival compared to historical results in Phase 1/2 studies.

4)Our product candidate has potential to kill tumors in a manner and could be used before surgery immediately after diagnosis or for treatment of cancers where there are no therapeutic agents or suitable local treatments available.

INT230-6 in Animals

Our first research studies in mice were conducted with organizations that provide services under contract, referred to as contract research organizations (“CROs”). Our Company collaborated with the Vaccine Branch of the National Cancer Institute (NCI) in Bethesda, MD. The research with the NCI was established after the National Institutes of Health awarded our Company a cooperative research and development agreement (CRADA). The program was quite successful and culminated with the publication of a paper in July 2019 that we jointly authored with the NCI. In that publication we reported that INT230-6 treatment resulted in regression from baseline in 100% of the tumors and complete response in up to 90%. Experiments showed a critical role of T-cells in promoting complete tumor regression. Mice with complete response were protected from subcutaneous and intravenous re-challenge of cancer cells. Thus, immunological T-cell memory was induced by INT230-6.

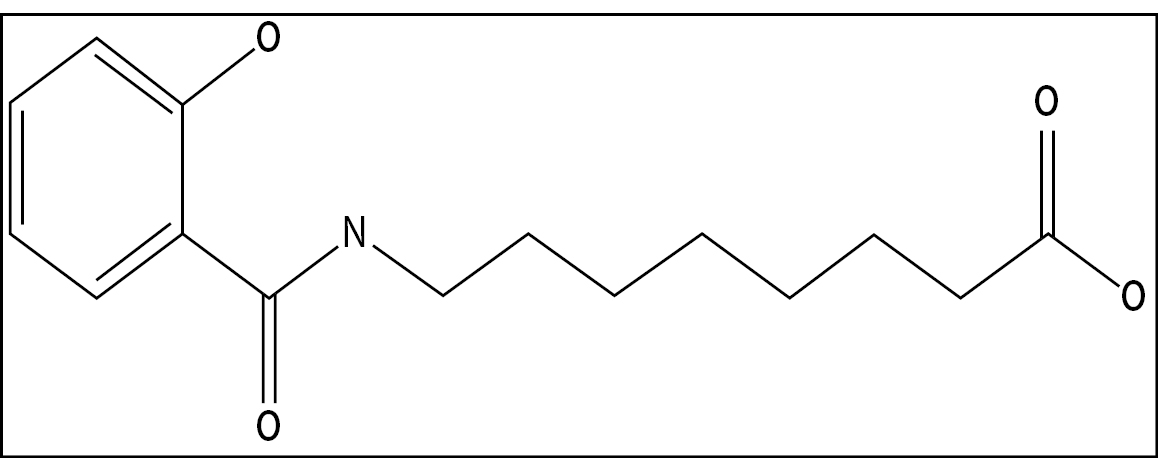

As part of our own research, we formulated cisplatin in water without the SHAO and added a noncolloidal dye. When injected into a human pancreatic tumor grown in a mouse model, we observed that the water formulation of the drug without the SHAO was not absorbed in the tumor. The liquid mostly leaked from the tumor. However, the formulation that

incorporated SHAO was readily and rapidly absorbed by the tumor in a dose dependent manner as shown in Figure 2 below.

Figure 2 – Comparison of drug dispersion/absorption in tumors with and without our DfuseRx technology.

Dense human pancreatic cancer BXPC-3 tumors were grown in severe combined immunodeficiency mice. Injections using a metered pump of the cisplatin with dye in water were compared to INT230-6 with dye. Fourteen mice were treated. INT230-6 is well absorbed and distributed throughout tumors (right side images) compared to the drug alone in water which leaks out (left side images). Data published in the International Journal of Molecular Sciences June 2020 doi.org/10.3390/ijms21124493.

In addition to formulation experiments we conducted growth inhibition experiments using large tumors (>300 mm3) and treated with low drug doses. Typically, research conducted by other companies developing cancer products use small tumors (25 to 100 mm3). Such companies also often use large drug doses in their studies with drug amounts that are five to fifty-fold above our dose amounts. Our product candidate can completely eradicate murine tumors, an effect that is termed a complete response (CR). Most competitors show only a slowing down of the tumor’s growth rate over time.

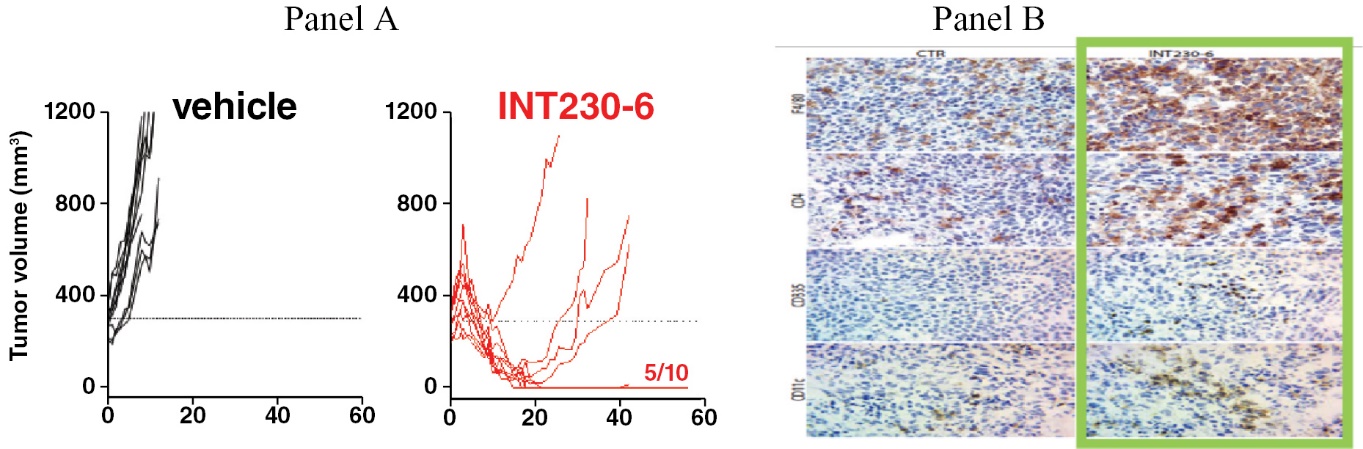

INT230-6 regresses tumors over time as shown in Figure 3 panel A and extends animal life compared to the drugs given alone intratumorally at the same dose without our technology. In addition, our drug candidate shows superior efficacy given intratumorally compared to dosing the drugs intravenously. Often animals with a CR are permanently protected against the cancer. This means upon re-inoculation with the same cancer new tumors do not grow. The protective effect happens whether the cancer cells are reinoculated under the skin or administered intravenously indicating a broad systemic immune protection.

Through our research collaboration with the NCI, we generated data regarding the mechanism of action for our lead product candidate. INT230-6 shows direct tumor killing and immune cell activation. The direct tumor cell death is caused by action of the two potent agents (cisplatin and vinblastine sulfate). Data generated to date indicates infiltration of dendritic cells into the tumor which can present antigen to activate CD8 and CD4 immune T-cells against the cancer. Survival and tumor eradication are mostly driven by CD8+ T-cells. Thus, our product candidate generates high quality, vaccine-like antigen from the attenuated tumors to promote the immune activation. The Company also published data showing increases in dendritic cells, macrophage, T-cells and Natural Killer (NK) cells 10 days after intratumoral treatment in mouse colon tumors. Selective immune depletion of CD4 and CD8 abrogates the therapeutic effect. Figure 3 panel B that shows the influx of various immune cell into the tumor microenvironment.

The scope of the NCI studies was to assess growth inhibition, survival and immune activation. Naïve mice were SC challenged with 1 × 106 C26 cells into the right flank. Vehicle or INT230-6 (0.5 mg/ml cisplatin, 0.1 mg/ml vinblastine sulfate, 10 mg/ml IT-006 cell penetration enhancer also referred to as SHAO) were intratumorally (IT) administered into 300 mm3 (approx. 8.5 mm in diameter, 100 μl/400 mm3 C26 tumor) SC tumors (n = 10/group) for 5 sequential days (day 0 to 4) and tumor growth was monitored. The fraction 5/10 indicates the number of complete responders. The log rank test indicates a significant difference between the groups (p<0.0001).

Figure 3 — Mouse data showing tumor reduction and immune activation

In Panel A on the left, 100% of animals receiving INT230-6 treatment for 5 days have a slight increase followed by a decrease from baseline, with 50% of animals having a complete response compared to no treatment controls with no decrease or complete responders (data generated by the NCI see OncoImmunology 2019 Vol 8 No 10; 15). Panel B cell staining shows an increase in the immune infiltrates. Data from Int. J. Mol. Sci. 2020, 21, 4493.

INT230-6 is Synergistic with Checkpoint Blockade

Nature has created checkpoints on the immune system to regulate the activity of the immune cells. These pathways are crucial for self-tolerance to prevent the immune system from attacking healthy cells indiscriminately. Large pharmaceutical companies such as Merck, Roche, AstraZeneca, Pfizer and BMS have developed new types of anti-cancer anti-body drugs with the ability to modify and block the checkpoints on the immune system.

Our results show strong benefit in regressing tumors with the combination of INT230-6 and checkpoint inhibitors which leads to improve survival. The data showed the combination of our product candidate with either anti-PD-1 or CTLA-4 antibodies in a dual tumor (metastatic) cancer mouse resulted in additive benefit. The data was generated by our partners at the National Cancer Institute and under our CRADA and published (OncoImmunology 2019 Vol 8 No 10; 15).

Preclinical Good Laboratory Practice (GLP) Safety of INT230-6

During a meeting in 2014 with the FDA we reached agreement on an accelerated safety and manufacturing program. We successfully completed the needed tasks to begin clinical testing that included conducting pharmacology studies (showing activity of the drug), toxicology studies in two animal species, analytical methods development, manufacturing scale up, and regulatory submissions. All these steps were completed by 2015. The data showed that the use of SHAO did not change or increase the toxicity of cisplatin or vinblastine sulfate. Analytical results showed the two drugs remain unchanged chemically when INT230-6 is stored properly, which is in a standard freezer at -20°C.

Clinical Regulatory Interactions

In the United States, the FDA regulates drug and device products under the Federal Food, Drug, and Cosmetic Act and its implementing regulations. We filed our IND application for our study IT-01 entitled “A Phase 1/2 Safety Study of Intratumorally Administered INT230-6 in Adult Subjects with Advanced Refractory Cancers” and held a meeting with senior FDA officials in November 2016. In December 2016, the FDA provided us a “Study May Proceed” letter.

We also met formally with the HC in a CTA meeting in 2016. We filed the CTA and held meetings with senior HC officials. Health Canada provided us a “No Objection” letter in early 2017. As we have progressed our study, we filed several amendments since 2017 and have received “No Objection Letters” each time from Health Canada. We have been treating patients continuously under both our IND and CTA since May 2017.

The regulatory agencies agreed to permit setting the drug dose based on tumor volumes rather than using alternatives such as dose based on a patient’s height and weight. Our belief is that using the patients’ total tumor burden (“TTB”) instead of body size is a more personalized and precise approach to ensure that patients receive an appropriate dose for their unique cancer burden. Better dosing could lead to maximized efficacy with minimized side effects. In our clinical trial, tumor volume is calculated from radiographic imaging on target tumors at baseline. Dose for a given tumor is set based on its size.

IT-01 Phase 1/2 Clinical Trial

Study IT-01, was completed in 2023. The study design permitted our product candidate to be tested in several different cancer patient populations with dosing into both superficial e.g. squamous cell, thyroid, breast, head and neck, lymph, skin, and deep body cancers such as those found in pancreatic, uterus, liver, kidneys, colon, bile duct, fat, muscles (sarcoma) and lung. The clinical trial sought to determine the safety and potential efficacy of dosing INT230-6 directly into several different types of cancers. We tested our product candidate in over 20 different cancer types.

IT-01, is listed on clinicaltrials.gov; NCT03058289. The hospitals that enrolled patients in the United States were: the Sydney Kimmel Cancer Center at Johns Hopkins, The Fox Chase Cancer Center at Temple University, the University of Southern California’s Norris Cancer Center, LA County and HOAG Presbyterian Hospitals of the University of Southern California medical system, the UMASS Memorial in Worchester Massachusetts, Columbia Presbyterian in New York, the Princess Margaret Hospital which is part of the University Health Network in Toronto, and the Houston Methodist.

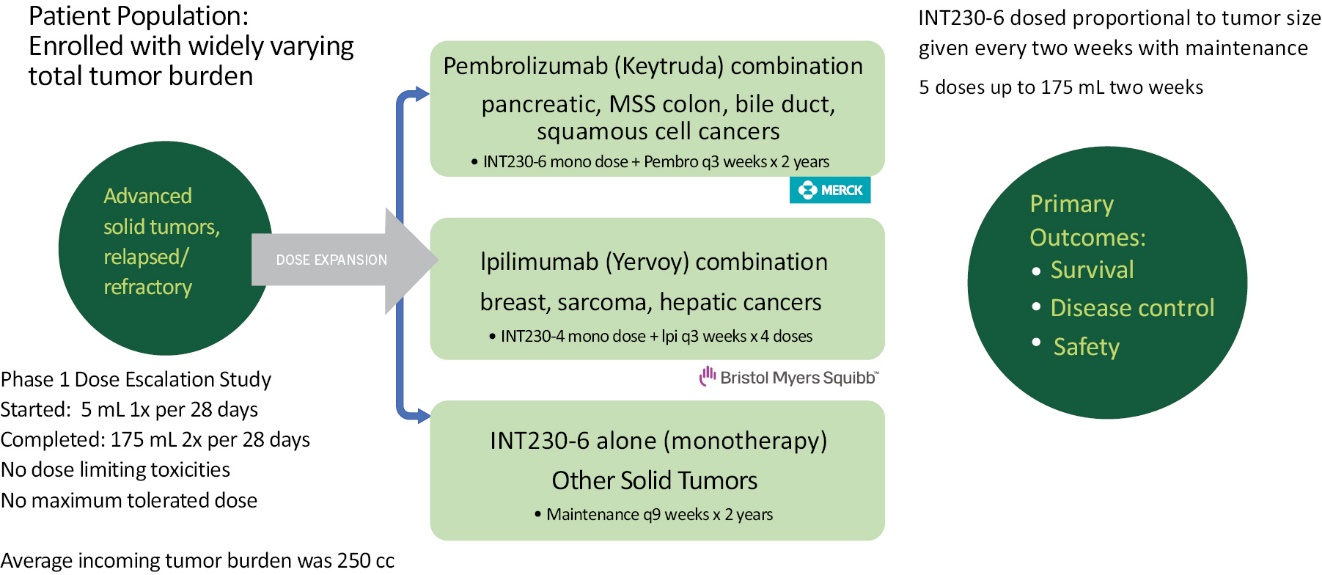

In 2019 we partnered with Merck and in 2020 we partnered with BMS. We treated 30 patients having various cancers using INT30-6 with Merck’s Keytruda® (pembrolizumab) and 18 patients with BMS’s Yervoy® (ipilimumab). A schematic of the final Phase 2 study’s three dosing cohorts is shown in Figure 4 below. The final data and clinical study reports were provided to the partners in December 2023.

Figure 4 — Schema of the 3 final dosing groups for the metastatic study IT-01.

Results from IT-01 Phase 1/2 Clinical Trial

Safety

The Phase 1/2 study treated refractory patients, who failed multiple lines of therapy. One hundred ten (110) subjects were treated in IT-01. The results of the escalation portion, which included up to 175 mL per session every two weeks, indicated a favorable safety profile of INT230-6 with or without immunotherapy, with only 8 patients out of 64 on INT230-6 alone experiencing grade 3 related adverse events. The most frequent related adverse events include localized tumor related pain.

The majority of treatment related adverse events have been low grade (grade 1 or 2). A total of 15 patients out of 110 (13.6%) had at least one grade 3 adverse event in study IT-01. The primary grade 3 events have been pain, fatigue vomiting anemia, rash, dehydration and dizziness. There was one grade 4 adverse event, a decrease in the number of neutrophils, the most common type of white blood cell that contributes toward the healing of damaged tissues and resolving infections. There were no grade 5 treatment related adverse events reported. No maximum tolerated doses were established.

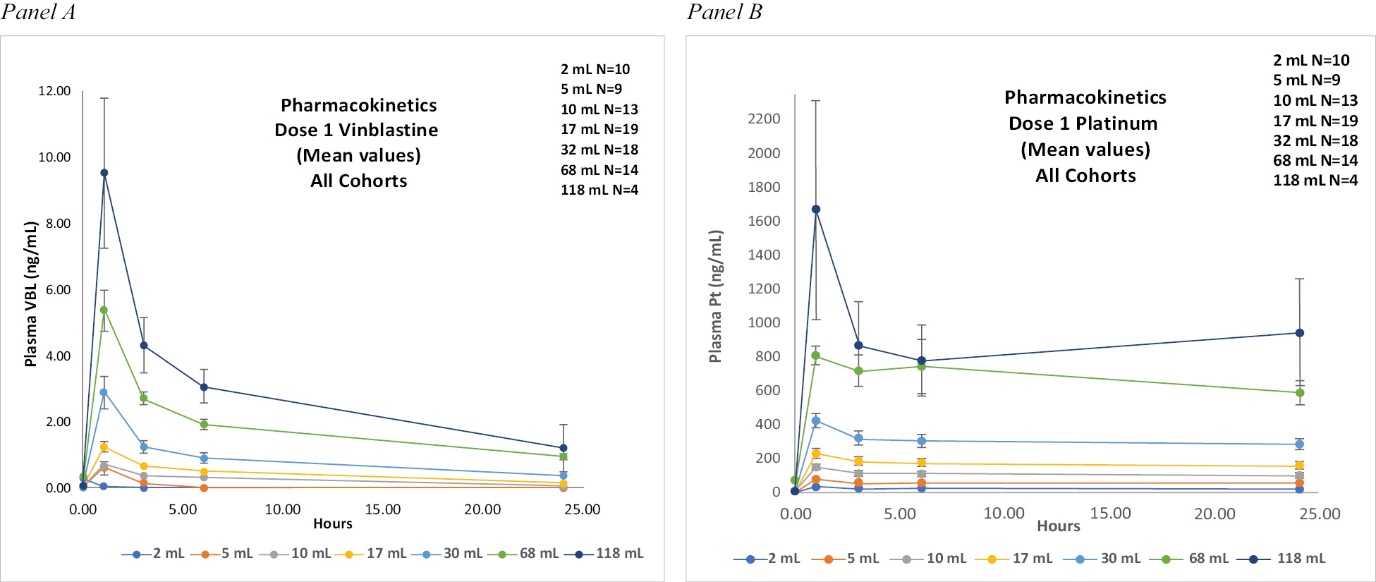

Even though our product candidate is dosed directly into the tumor, a key element of safety is to observe how much drug enters the bloodstream. Toxicities are linked to the circulating levels of the active agents in the blood. We measure circulating concentrations of the three main ingredients, SHAO, cisplatin (as platinum metal) and vinblastine sulfate, in the blood. This type of data is referred to as pharmacokinetics (“PK”). Data that measured the circulating levels of the key ingredients has been generated from the ongoing study in metastatic patients. The amount of vinblastine sulfate seen in

plasma of patients is much lower than a lesser dose given IV. Cisplatin is reduced to metal rapidly and is challenging to measure in blood even for IV dosing. A measurement of vinblastine sulfate provides a better understanding of the PK.

In our study, vinblastine plasma concentrations increased proportionally to the amount of drug administered. In essence, the concentration of vinblastine seen in the blood increased proportionally to the dose given intratumorally. See Figure 5 Panel A. This effect is independent of the cancer type and highly reproducible. As would be expected, the amount of the vinblastine seen in the plasma when given intratumorally was less than 5% of the blood concentrations had the drug been given intravenously. Our two highest average doses of INT230-6 were 118 mL and 80 mL. These dose volumes contain 11.8 and 8 mg of vinblastine sulfate and result in 9 and 6.8 nanograms per mL of vinblastine in blood plasma, respectively, at one hour post-dose.

At six hours post-dose, the amount dropped to about 3 and 2.2 nanograms per mL. Publications show the plasma concentration of a standard dose of vinblastine sulfate (6.5 mg for an average sized person) can be estimated. Based on pharmacokinetic studies of vinblastine in the literature (Links, M., Cancer Investigation Volume 17, 1999 – issue 7479-485), we estimated a vinblastine plasma level of 240 ng/mL at 6 hours for an IV dose of ~5.1 mg. Comparing our blood plasma concentration profile for vinblastine at various doses to the data from the Links cancer investigation indicates that >95% to 99% of the drug remained or degraded in the tumor post injection depending on the dose.

Cisplatin degraded rapidly. Measures of platinum metal are used in lieu of cisplatin for PK analysis as shown in Figure 5 Panel B. This drug retention in the tumor spares the patient the debilitating side effects of circulating drug. Indeed, the low observed plasma levels of the potent agents following INT230-6 dosing correlates with the low grade of side effects observed. Thus, IT dosing INT230-6 compares favorably to the toxicities normally associated with cisplatin and vinblastine sulfate when given intravenously at comparable doses.

Figure 5 — Free vinblastine (VIN) levels and platinum metal in blood plasma over time for intratumorally (IT) administered INT230-6.

Cytotoxic components in INT230-6 have minimal systemic exposure and short half-life. Most of the active drug remains in the tumor as a result INT230-6 appears to have favorable safety data to date.

RECIST (Response Evaluation Criteria in Solid Tumors) for Efficacy

A standard way to measure how well a cancer patient responds to a treatment is based on whether tumors shrink, stay the same, or get bigger. Efficacy assessments for evaluating changes in tumor size in clinical trials are typically conducted with standardized oncology response criteria, for example, Response Evaluation Criteria in Solid Tumors known as RECIST or a newer version 1.1 (RECIST 1.1). There are additional guidelines for immunotherapeutic trials (iRECIST). These criteria measure the change in longest diameter of tumors to assess drug response. An increase in longest diameter of > 20% is considered progressive disease. The rationale behind this is that tumors should generally become smaller. The main benefit of iRECIST is to afford physicians the opportunity to confirm progression with a follow up scan of the tumors 1 to 2 months later. However, both RECIST 1.1 and iRECIST criteria were designed only to assess response to systemic therapies.

Our study initially employed RECIST 1.1, and subsequently, iRECIST methods for determining the efficacy of INT230-6. INT230-6 induced tumor regression in both injected and non-injected lesions in several patients. However, tumors often increased in the longest diameter prior to shrinking using our drug, which we attribute to three factors. The first is high absorption by the tumor of our drug. Prior to the first efficacy scan, during the first two months (after 5 sessions) of INT230-6 treatment, patients would have received depending on the cohort a dose volume of drug injected into the tumor equivalent to 25% to 250% of the tumor’s volume. The second factor is an infiltration of immune cells into the tumor that can increase the longest diameter. Finally, tumors can become cystic. We have reported these data at major medical conferences (ASCO 2021, 2022, 2023, CTOS 2022, 2023) to indicate that RECIST methodology may be an inaccurate measure of clinical benefit for intratumoral INT230-6.

Tumor Death (Necrosis)

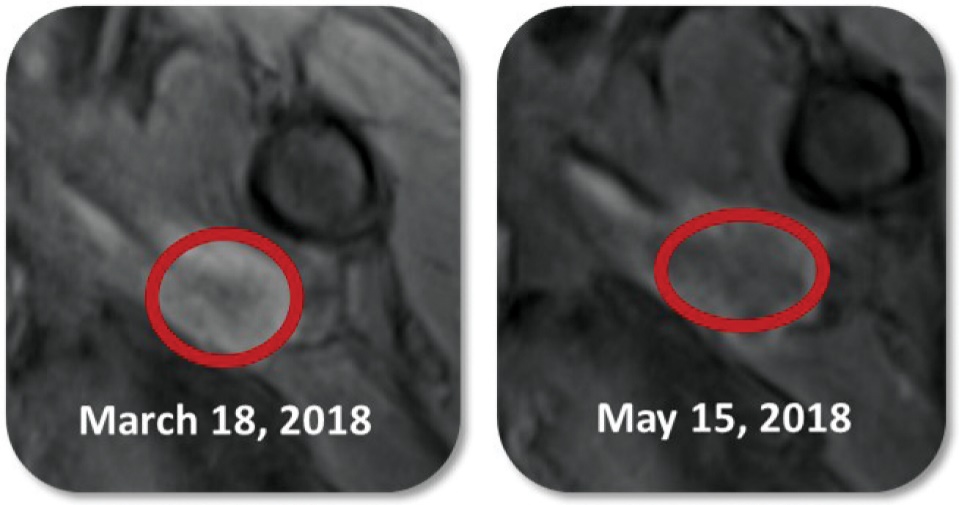

Investigators report significant necrosis (reduced contrast uptake in the CT image) in many injected tumors including adrenocortical, breast, chordoma, colon, head and neck (H&N), lung, sarcoma and squamous cell. Figure 6 below is an example of a squamous cell tumor that became necrotic by the 2-month scan. The darker contrast of the tumors indicated that significant necrosis of the tumor occurred following treatment.

Figure 6 — Images showing that INT230-6 induces tumor necrosis (death) in the injected tumors.

The patient in these images had a squamous cell carcinoma. His cancer continued to progress after 2 surgeries, radiation, and chemotherapy. The patient enrolled in our study in January 2018 with two 10 cm3 deep tumor nodules in his upper arm muscle. The hospital recommended total arm and shoulder amputation. This subject received 4 intratumoral injections equal to 100% of his 2 tumors’ volume. The drug was dosed at ratio of 1 mL per 4 cc of tumor. In the red circle in the left panel there is bright contrast indicating active cancer. At the first scan on May 15, 2018, there was an increase in tumor size, significant necrosis (lack of contrast) and inflammation observed (right panel). This patient has retained his arm and shoulder and is alive as of the last follow up visit in December 2022.

Abscopal Effects

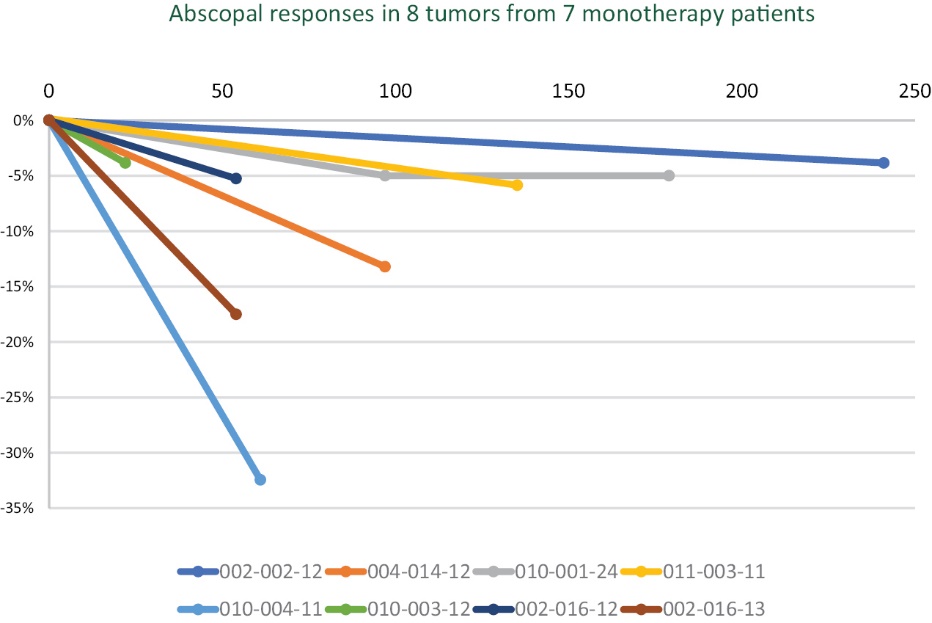

In the metastatic study several subjects showed tumor size reduction of non-injected lesions in lymph nodes, liver, lung, perineum, and retroperitoneal areas (i.e. abscopal effects to visceral lesions). The apparent abscopal effect was seen primarily in patients that received a dose greater than 40% of their TTB. Abscopal effect rates may be even higher than known. Sites did not report existing tumors under 1 cm in diameter. In addition, many tumors above 1 cm were not followed and unreported. We captured images from all subjects to be able to determine the true abscopal effect in all subjects at a future time and this analysis is in progress. Figure 7 below shows uninjected tumor diameter changes over time of patients with confirmed reports of abscopal effects.

Figure 7 — Change in longest diameter of uninjected tumors over time (abscopal effects) monotherapy subjects only.

Tumor Diameter and Corresponding Volume

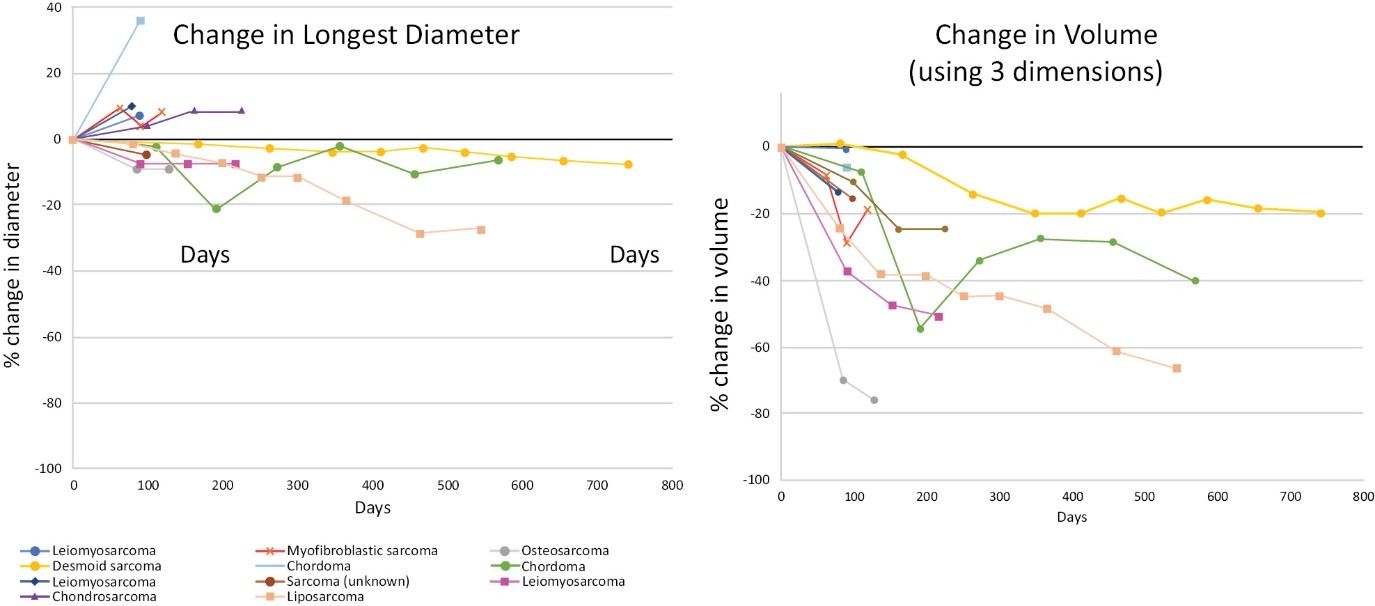

For injected tumors, changes in longest diameter often do not correlate with changes in volume. Dosing is completed just prior to their first scan when the increase in tumor diameter is most likely to be highest. As noted above, RECIST measurements of whether a patient’s cancer is stable, decreasing or progressing are based on the changes in the tumor’s longest diameter. An increase in longest diameter above a threshold would indicate progression. In Figure 8, the graph on the left shows the change in individual tumors’ longest diameter over time. The graph on the right shows the same tumor’s volume over time. Tumors in many patients treated with INT230-6 can show an increase or no change in longest diameter with a decrease of the corresponding tumor’s volume. There is also a much greater volume decrease than expected for the slight decrease in longest diameter. In some cases, tumors can become cystic, which on imaging looks like a large increase. The increase in size was seen on scans until cystic tumors were drained. These data provide further evidence that RECIST may not be a good indication of efficacy for INT230-6.

Figure 8 — Chart showing that use of INT230-6 may increase tumor’s longest diameter while decreasing the tumor’s volume (sarcoma patients only).

In the left figure each color represents the change in diameters of an individual patient’s group of tumors. In the right figure the same color represents that same patient’s change in tumor volumes.

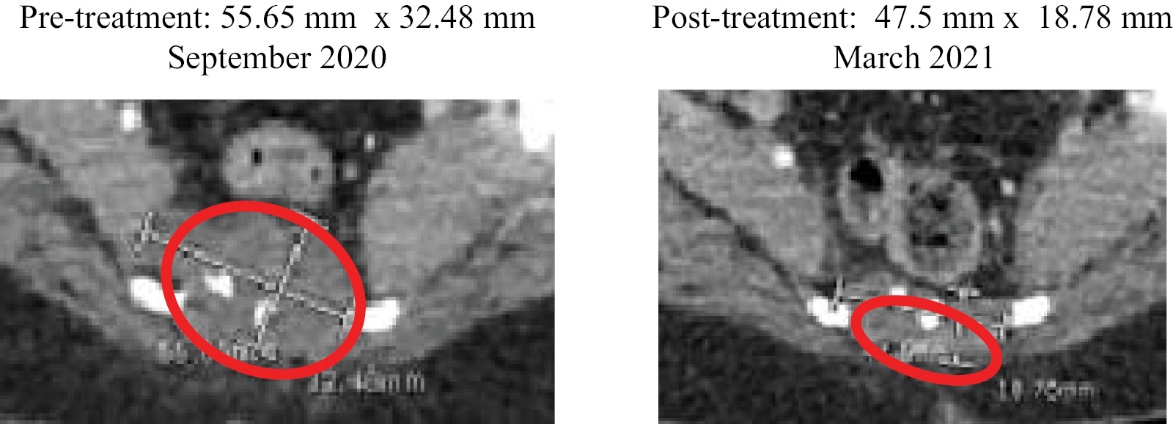

Visualizing a change in 3 dimensions also shows the limitations of using RECIST methods for determining efficacy for intratumoral INT230-6. Figure 9 shows the scan of a sarcoma patient’s tumor pre- and post-dosing. The longest

diameter declines by 15%, while the second longest diameter declines 42%. Using RECIST criteria, this patient would have been classified as having stable disease, whereas the World Health Organization, which uses the two longest diameters, would classify this patient as having had a partial response, which is a better outcome.

Figure 9 — Scan showing change in two longest diameters of an injected sarcoma tumor at the base of the spine.

We believe that RECIST measurements (longest diameter) are inappropriate to capture efficacy with INT230-6. As a result, overall survival, the FDA’s gold standard efficacy endpoint, is a better measure of INT230-6’s performance in metastatic cancer.

Disease Control Rate

Even though RECIST was deemed to be less accurate for measuring efficacy a secondary objective of IT-01 was to assess the preliminary efficacy of INT230-6 by measuring the disease control rate (DCR) based on the (RECIST) and immune RECIST (iRECIST) criteria. The DCR rates for the study are shown below.

| | | | | | | | |

Monotherapy cohorts | | Disease Control Ratea |

Total (all subjects) (N = 64), n (%) | | 75.0 (62.6, 85.0; 48) |

Dosed ≥ 40% TTB (N = 48), n (%) | | 83.3 (69.8, 92.5; 40) |

Dosed < 40% TTB (N = 16), n (%) | | 50.0 (24.7, 75.3; 8) |

| | | |

Sarcoma only (N = 15), n (%) | | 93.3 (68.1, 99.8; 14) |

Dosed ≥ 40% TTB (N = 11), n (%) | | 90.9 (58.7, 99.8; 10) |

Dosed < 40% TTB (N = 4), n (%) | | 100 (39.8, 100; 4) |

Prior treatmentb | | |

Yes (N = 31), n (%) | | 74.2 (55.4, 88.1; 23) |

No (N = 33), n (%) | | 75.8 (57.7, 88.9; 25) |

Survival — Phase 1 Basket Studies

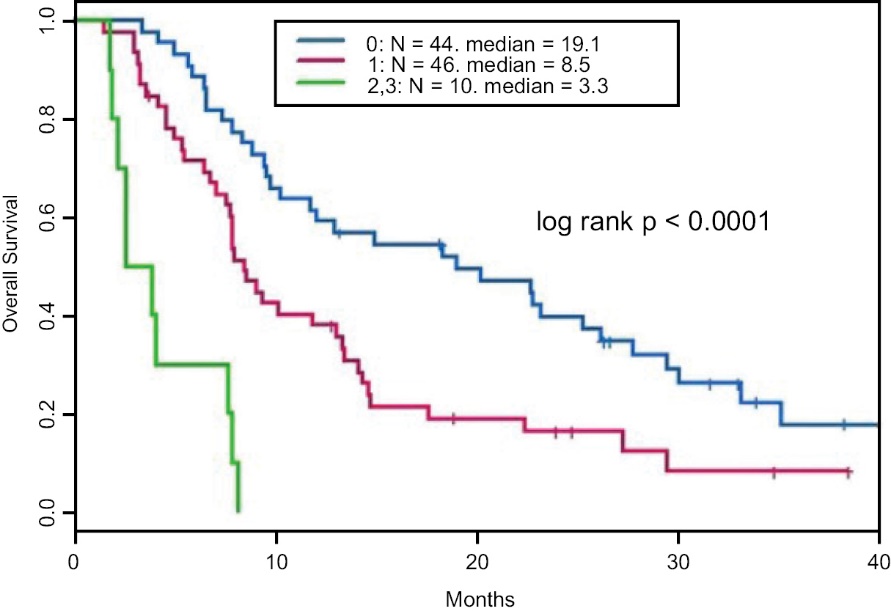

The primary objectives of Phase 1 trials are to define the safety or toxicity profile of a new drug and to determine the dose for further evaluation in Phase 2 trials. Patients enrolled in Phase 1 are therefore placed at risk of toxicity, in exchange for an undefined and limited clinical benefit. Furthermore, patients who are considered for Phase 1 trials may be regarded as vulnerable because their physical condition may be deteriorating due to advanced cancer malignancy for which no further standard treatment options exist. Efficacy is not usually the primary objective. Most patients in Phase 1 studies have low survival expectations that ranges from 3 to 8 months depending on the type of cancer and patient’s incoming health. (see Chau, N., BMC Cancer volume 11, Article number: 426 2011).

Over the past two decades the development of a prognostic score to predict survival of patients treated in Phase 1 studies has been completed and validated by the Royal Marsden Hospital (RMH) in the United Kingdom. The score, which ranges from 0 to 3, is highly correlated of overall survival (OS) outcomes. A score of 0 suggests longest potential survival and a 3 worst. Many studies show that subjects enrolled in Phase 1 have survival of under 6 months when RMH scores greater than or equal to 1.

In our study IT-01 patients were enrolled whose cancer progressed following treatment using all approved and some experimental therapies suitable for their specific disease. Forty-three (43%) of patients had previous had an IV form of a platinum-based drug including cisplatin. Forty-four percent (44%) had previously received an anti-PD-1 antibody. Efficacy data from 64 patients enrolled in IT-01 is available from patients receiving INT230-6 alone (referred to as monotherapy). There were over 820 different tumor injections conducted over the course of the trial with over 502 being into visceral deep tumors.

Study IT-01 was a Phase 1/2 dose escalation (i.e. the Phase 1 basket portion) and Phase 2 (expansion of specified cancer types). These types of studies are primarily testing safety in the Phase 1 and determining whether there is an efficacy signal in the expansion compared to historical data. There was no control arm in IT-01 and no randomization. Therefore, there is no comparator to determine the significance of any given endpoint. See Table below for the patient population.

Final INT230-6 monotherapy population (n=64) in IT-01

| | | | | | | | | | | | | | |

Type of Cancer | | Monotherapy

Number of

Patients | | Monotherapy

Percent of

Population |

Sarcoma | | 15 | | 23% |

10 Othera <4% each | | 13 | | 20% |

Skin (Melanoma/Merkle) | | 6 | | 9% |

Squamous cell carcinoma | | 6 | | 9% |

Colorectal | | 5 | | 8% |

Breast | | 4 | | 6% |

Head and neck | | 4 | | 6% |

Ovarian | | 4 | | 6% |

Pancreatic | | 4 | | 6% |

Cholangiocarcinoma | | 3 | | 5% |

____________

aOthers include: Adrenocortical carcinoma, Anal, Bladder, Cervical, Eccrine, Lung, Metastatic Cancer of Unknown Primary, Pseudomyxoma peritonei, Renal, and Thyroid.

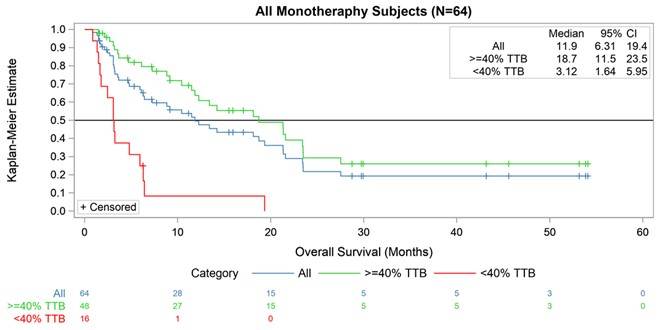

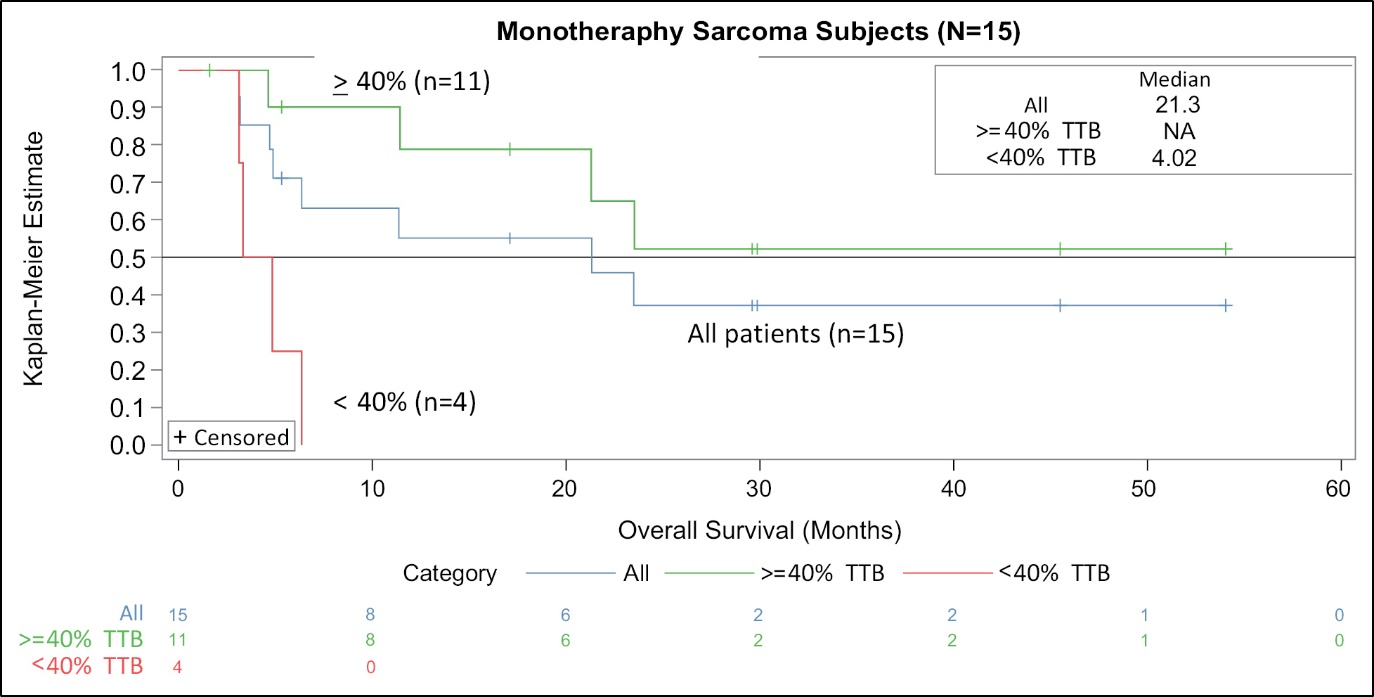

Patients receiving a monotherapy dose of INT230-6 above 40 percent of their TTB measured in cubic centimeters had a statistically significantly longer survival than patients who received treatment to less than 40% of their TTB. The subjects receiving a dose >40% of their total incoming tumor burden also lived much longer than would be expected for patients in a Phase 1/2 basket study. These data indicate a potentially active drug. Given the small size of the population, the heterogeneity of the cancers and variability of the incoming tumor burdens, the high and low dose groups may have been different in a way that we may not have been able to measure. We observed a strong overall survival signal in just sarcoma patients; however, this Phase 2 population size was also too small to properly assess effectiveness of INT230-6. As a result, we have determined that overall survival, an endpoint preferred by the FDA for cancer clinical trials, is the most appropriate metric to prove efficacy of our drug candidate to treat metastatic disease. Study IT-01 also indicates that soft tissue sarcoma, at cancer type with high unmet medical need, would be a suitable disease for a Phase 3 trial to evaluate the efficacy of INT230-6.

In our metastatic study survival appears to be impacted by the total dose a patient received relative to number and size of their tumors. Patients receiving a higher percentage of drug (mL) relative to their TTB (cm3) remained on study longer regardless of the cancer type. A patient’s TTB is calculated by adding up the volumes of all reported tumors. Simply stated, the more drug given to more tumors, the more likely a subject would be alive longer, though not all tumors need be treated. Killing more of a patient’s cancer is beneficial.

The probability of survival for a given population can be plotted. Figure 10 panel A below illustrates the survival for all monotherapy INT230-6 subjects. See Table below for the patient population.

Treating only with our drug candidate, approximately 50% of patients would be expected to be alive at one year (blue curve) with a median overall survival (mOS) expected of 11.9 months. Subjects dosed an amount of INT230-6 that was less than 40% of their TTB had a mOS of 3.1 months. This result is shown in the red curve and is comparable to survival expected in historical Phase 1 basket studies (See Chau, N., BMC Cancer volume 11, Article number: 426 2011). Patients that received a dose of INT230-6 to greater than 40% of their TTB had a ~63% chance of being alive at 1 year and the

median overall survival was 18.7 months. These results indicate that survival improves for those dosed to greater than 40% of their TTB compared to those receiving under 40%. While there were no differences statistically in the two populations with regards to incoming tumor burden; the sample size is small and the average values for the green curve was lower.

Figure 10 — Kaplan Meier Estimates of Sarcoma Patient-Survival Dosing INT230-6 in study IT-01